Start trading with the HSBC Digital Investment Account

You can now open Investment Accounts straight through the HSBC Singapore app or online banking, in 5 quick steps.

A wide range of options are available from stock trading to funds. Plus, easily manage your wealth account online or through the app with our Digital Wealth Dashboard.

The account is free to maintain, but each product has its own fees.

Open an investment account today

Already our customer? Open our award-winning investment account today.

Don't have an existing current/savings account with us?

You will need a current/ savings account to open an investment account for trading online or via the HSBC Singapore app.

Embark on your Wealth Journey with HSBC Singapore Digitally today

Seamless Digital Investment Account Opening Journey

Get access to a wide range of solutions to accelerate your wealth journey, easily open via HSBC Singapore App or Online Banking.

Invest wherever you are

No need to visit a branch* - Invest anywhere, anytime via online trading or mobile app.

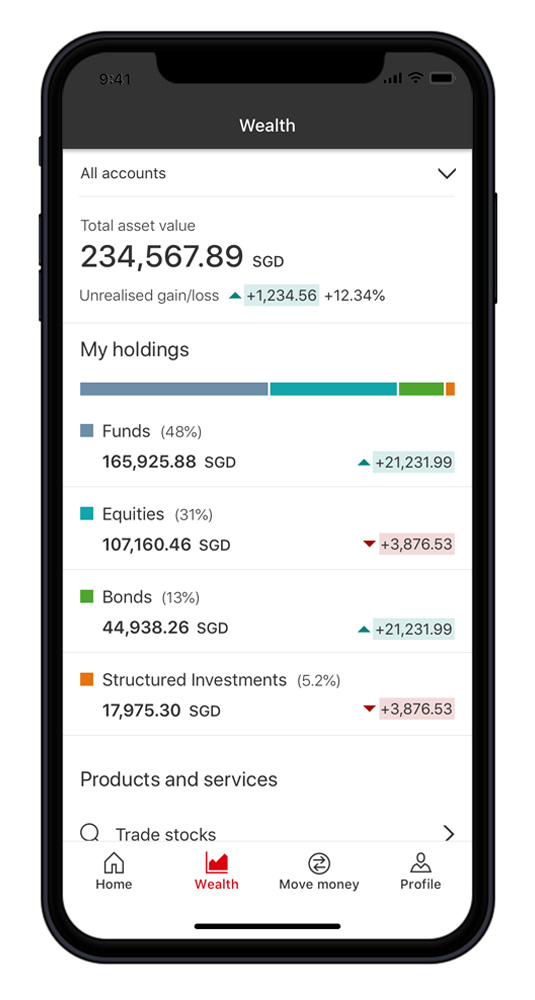

Digital Wealth Dashboard

Keep track of your wealth and investments online and through the app.

Secure investments

You'll have peace of mind with our reliable and innovative app.

Investment options

Once you've opened your Investment Accounts through our app or online banking, you can choose from a wide range of investment options that could help to grow your wealth.

- Spread the risk in your investment portfolio with our choice of structured products.

Who can apply for Digital Investment Accounts?

Before you apply, check that you:

- have a deposit account with HSBC

- are aged 18/21 or older *

- have up-to-date personal details with us

- have access to online banking

New to HSBC? Open an account online now

*Dependent upon type of Investment Account

How to open your Digital Investment Accounts to start trading

Invest wherever you are

Open an Equity Investment Account or Unit Trust Investment Account instantly. It only takes a few minutes to complete the application thanks to our pre-filled digital form.

- Log on to your HSBC Singapore app and open the 'Wealth' tab

- Click on 'Open account to invest' to check your eligibility to open an account

- Review your details

- Answer a few questions to determine your financial knowledge & complete other documents to start your Wealth Journey

- Review our terms and conditions then submit your application

And that's it, just 5 easy steps to open your Investment Accounts straight from your mobile.

Important information

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Disclaimer

*For investing in Bonds, please visit the nearest branch.

Specific terms and conditions governing digital investment account, offers and investment options also apply.

This material is for information only and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment options and/or offers. The Bank does not make any guarantee, representation or warranty and does not take responsibility as to the accuracy or completeness of the information on this web page. Opinions expressed herein are subject to change without notice.

The information contained on this web site is intended for Singapore residents only and should not be construed as an offer, solicitation or recommendation of any product or service in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction.

The mention of any offers, investment options or investment product ("product") should not be construed as representing a recommendation to buy or sell that product, nor does it represent a forecast on future performance of the product.

The specific investment objectives, personal situation and particular needs of any person have not been taken in consideration. You should therefore not rely on the content of this material as investment advice to make investment decisions. Before you make any investment decision, you may wish to consult a financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you.