Wherever you are today, we could help you create a better tomorrow

The word 'wealth' means different things to different people. For some, it could be property. For others, it's their family. For us, it means being able to make your money work harder and to protect what matters, so you can build a brighter future.

Whether you've been investing for a while or you're wondering where to start, we can help you to take actions today to realise your dreams.

Enjoy global wealth management services and banking support for you and your loved ones, wherever you are in the world.

Digital wealth solutions

HSBC digital wealth tools

Our suite of digital wealth tools provide quick and easy access for you to manage finances and ensure your wealth needs are met, anytime, anywhere. Transact, invest and keep yourself updated with the latest market news, right at your fingertips.

Enjoy the convenience of managing your wealth on your own or virtually with your Relationship Manager.

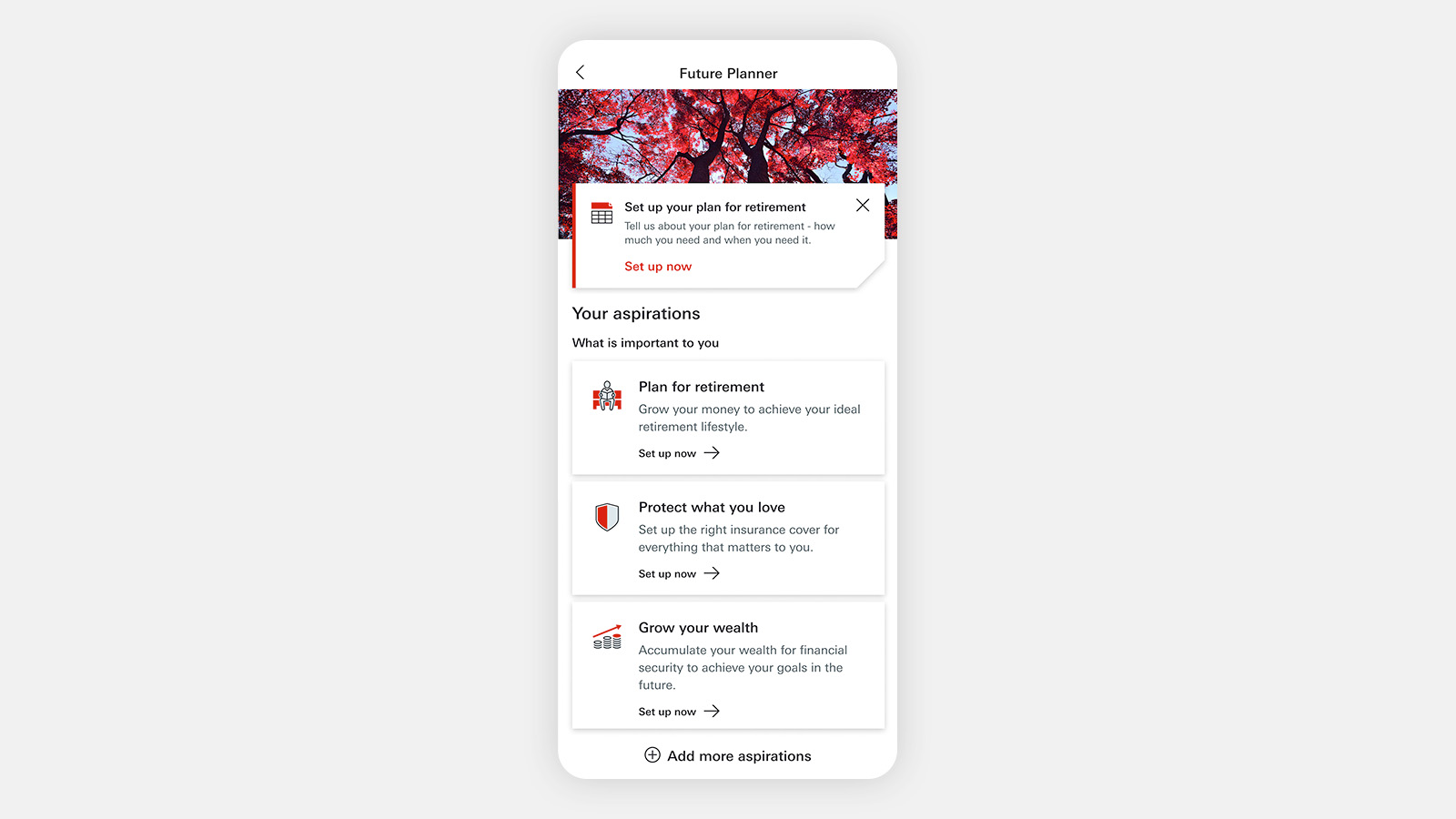

Achieve your wealth priorities with HSBC Future Planner1

With the all-new HSBC Future Planner tool, achieving your life aspirations has never been easier. This intuitive tool is designed to help you set and achieve your aspirations one step at a time, giving you both confidence and clarity. Get started with HSBC Future Planner today via the HSBC Singapore app.

Benefits of HSBC Future Planner1

- Focus on what matters most

Identify and prioritise your aspirations in order of importance, from now until retirement. - Set clear targets

Know exactly how much you need for each aspiration so you can plan accurately and take decisive next steps. - Fulfil your goals

Transition from planning to investing digitally and watch your aspirations come to life. You may also consult our Relationship Managers for further guidance.

Financial planning tools

Introducing "SG Chat" - a secure and instant messaging tool which enables you to communicate with your relationship management team on messaging platforms like WhatsApp and WeChat. SG Chat is a service exclusive to HSBC Premier customers.

- ChattingCommunicate with your relationship management team through a one-on-one or in a group chat.

- Document sharingShare and access documents in a safe and secure channel.

What would you like to do?

Invest your money

See the different ways you can put your money to work in our investment product.

Manage your portfolio

See all your investment holdings in one place on the HSBC Wealth Dashboard.

Move money abroad

Capitalise on exchange rate fluctuations with our foreign exchange services.

Manage your loans

Reduce your home loan interest by offsetting interest earned on your current account, with SmartMortgage.

Guides to modern money

You don't need a fortune to start investing

It's not just for the rich. See how you can begin your journey today.

Should you save or invest?

To invest or not to invest? Let us help you with that.

5 reasons to do your own investing

Handling your own investments is easier than you think

See more articles

Click here to access more wealth articles.

HSBC FinConnect

HSBC FinConnect is enabled by the Singapore Financial Data Exchange (SGFinDex) and lets you view your personal financial data, including information from other banks, SGX CDP and Myinfo securely in the HSBC Singapore app.

With HSBC FinConnect, you can get a clear overview of your money and investments, which makes it easier to map out and work towards your financial goals.

Before you invest

You'll need to complete a Customer Knowledge Assessment (CKA) or Customer Account Review (CAR) in online banking before you start investing in some of our products. There may also be some additional forms to complete depending on the product you are investing in. These include NYSE Market Data Agreement, Risk Warning Statement, W8BEN form, and Accredited Investor. You may complete these via the Document Center on the HSBC Singapore App or click the 'Document Center' tab on the Wealth Dashboard to update or renew your product forms.

More resources

Investment financing

Keep up with your long-term goals without worrying about short-term cash flow.

Accredited Investor Regime

All the important information you need to know about becoming an Accredited Investor.

Wealth Portfolio Intelligence Service

A new proprietary tool designed to help you achieve your investment goals.

Note

- Please note the tool and calculations are designed for use in Singapore. If you are outside Singapore, we may not be authorised to offer or provide you with the products and services through this tool in the country or region you are located or resident in. Any products and services represented within this tool are intended for Singapore residents. This tool and its contents do not constitute an offer of, or advice or recommendation on, financial products by HSBC Singapore. The results and/or estimates generated by this simulator tool are based on the information provided by you (including your preferred risk level) and are intended to be used for illustrative purposes only.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.