HSBC SmartMortgage

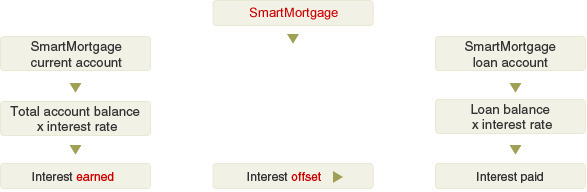

HSBC's SmartMortgage links your home loan account with a current account, reducing interest on your home loan with interest earned on your current account.

Leave us your contact details and we will be in touch shortly.

Benefits

- Reduce the interest payable on your home loanEarn interest on up to 70% of your outstanding loan amount or deposit balance, whichever is lower, with your current account. You can use it to offset part of the interest payable on your home loan.

- Pay off your home loan in less timeWith less interest payable, a larger portion of your monthly instalment will go towards your principal repayments, so you can pay off your home loan more quickly.

- Enjoy the flexibility to manage your finances, your wayYou can deposit funds into or withdraw funds from your current account at any time. As your current account is linked to your home loan, this gives you more control over how you manage your money and savings.

Illustration

| Example* | SmartMortgage | Conventional home loan | What you save |

|---|---|---|---|

| Interest payable over 2 years | SGD58,145 | SGD68,280 | SGD10,135 |

| Interest payable over 3 years | SGD85,555 | SGD101,030 | SGD15,475 |

| Loan tenor | 22 years and 4 months | 25 years | 2 years and 8 months |

| Example* | Interest payable over 2 years |

|---|---|

| SmartMortgage | SGD58,145 |

| Conventional home loan | SGD68,280 |

| What you save | SGD10,135 |

| Example* | Interest payable over 3 years |

| SmartMortgage | SGD85,555 |

| Conventional home loan | SGD101,030 |

| What you save | SGD15,475 |

| Example* | Loan tenor |

| SmartMortgage | 22 years and 4 months |

| Conventional home loan | 25 years |

| What you save | 2 years and 8 months |

*Important:

- The example assumes a loan of SGD1 million, with interest payable at 3.50% p.a. throughout the loan tenor, and an initial deposit of SGD200,000 in the current account.

- The example is for illustrative purposes only. It does not constitute an actual approval or an offer of any home loan facility by us. It should not be relied upon when making individual decisions on your home loan package. Credit facilities are granted at the sole discretion of HSBC.

Select the right loan

Buy a new property

HSBC Home Loans are the ideal way to start financing your dream home.

Get a home equity loan

Tap into the value of your home to capture investment or business opportunities.

Refinance my home loan

Enjoy savings on your monthly repayments by refiancing your existing loan.

More information

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.