ValueLife

Features & Benefits

ValueLife is a non-participating whole life insurance plan that lets you reduce your coverage, at either ANB 65 or 80.

Enjoy potential cost savings as your responsibilities in life evolve

When it comes to your later stages in life, most of your life and financial goals would have been achieved. Unlike typical whole-of-life plans, you can reduce your coverage, creating an opportunity for cost savings.Guaranteed lifetime protection with a limited premium paying term

ValueLife is designed with your future in mind. Pay regular premiums for only the first 15 years and be insured against Death and Terminal Illness up to ANB 99, and Total and Permanent Disability before ANB 65.Guaranteed refund of premiums

With ValueLife, you’ll receive 100% of the total premiums paid at the end of year 15, if you decide to surrender your policy and if there is no premium loading.Guaranteed maturity benefit

If no claims have been made up to ANB 99, the reduced Sum Insured, i.e. 70% of the basic Sum Insured, will be paid out in one lump sum as the maturity benefit.

How ValueLife can help you

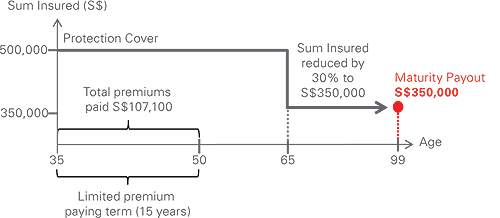

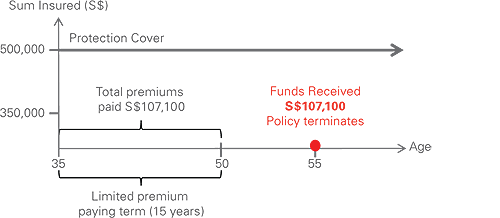

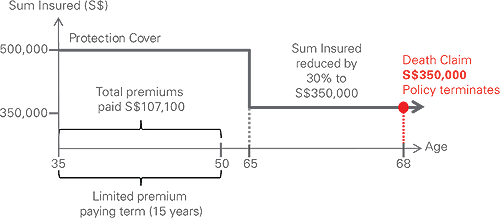

Mr. Tan, 35 years of age, purchases ValueLife for a Sum Insured of SGD500,000 and a monthly premium commitment of around SGD595. He selects ANB 65 to reduce the Sum Insured by 30% to SGD350,000.

Scenario 1: If no claims are made up to ANB 99, Mr. Tan will then receive a guaranteed maturity pay out of SGD350,000.

Scenario 2: At age 55, Mr. Tan, due to an unforeseen event, needs immediate access to his funds. He will then receive 100% of the total premiums paid (i.e. SGD107,100) if he chooses to surrender the policy. After which, the policy will be terminated.

Scenario 3: At age 68, Mr. Tan’s family raises a claim due to his unexpected demise. His family receives the reduced Sum Insured of SGD350,000. After which, the policy will be terminated. The funds could pay off the home loan and provide financial security for his family.

Get in touch

Call us

Call us on 1800 – HSBC NOW (4722 669) or find your nearest branch to apply in person.

For all policy servicing – related enquiries, please call (65) 6880 4888.

Find a branch

Visit us at any HSBC branch and talk to us in person.

What else should I know?

As buying a life insurance policy is a long term commitment, an early termination of the policy usually involves high cost and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

More Information

Disclaimer

ValueLife is underwritten by HSBC Life (Singapore) Pte. Ltd. (Reg. No. 199903512M) and distributed by HSBC Bank (Singapore) Limited ("HSBC"). It is not an obligation of, a deposit in, or guaranteed by, HSBC.

This webpage contains only general information and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person. This is not a contract of insurance and is not intended as an offer or recommendation to buy the product. A copy of the product summary may be obtained from our authorised product distributors. You should read the product summary before deciding whether to purchase the product. You may wish to seek advice from a financial adviser before making a commitment to purchase the product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. Please refer to the policy contract for the exact terms and conditions, specific details and exclusion of this product.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the LIA or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 1 February 2024.