Planning for your future requires a strategy that fits your goals and aspirations. We'll help you take charge of your finances with a financial planning review. Use it to:

- establish your risk appetite

- protect what's important to you

- identify wealth management solutions

- Grow your money via unit trusts and stock investments and more

In addition, find out how to optimize your loans in a cost-efficient way by speaking to our mortgage and loans specialists.

Speak to us today at any HSBC branch

Securely consolidate finances with HSBC FinConnect

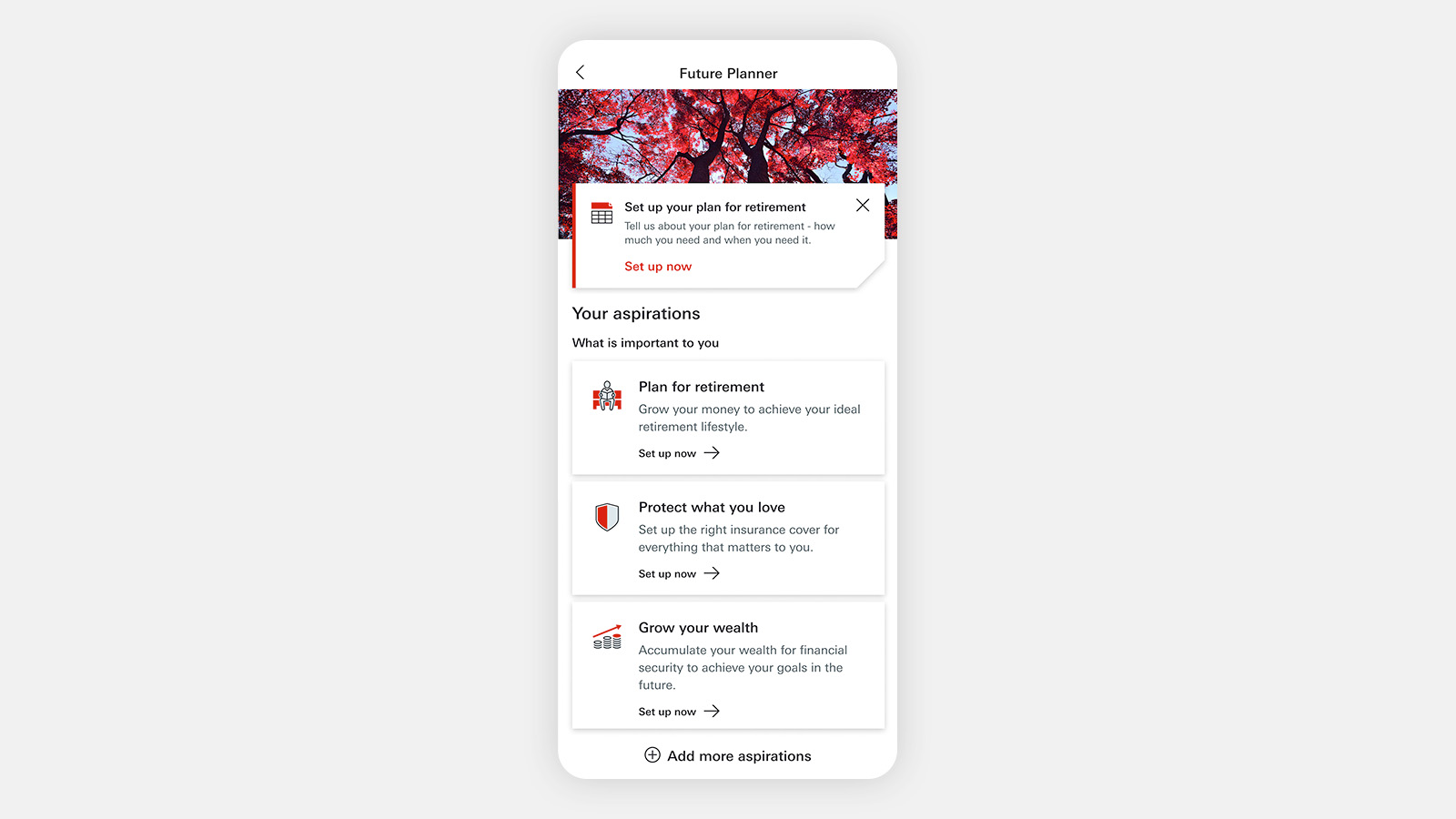

Achieve your wealth priorities with HSBC Future Planner1

With the all-new HSBC Future Planner tool, achieving your life aspirations has never been easier. This intuitive tool is designed to help you set and achieve your aspirations one step at a time, giving you both confidence and clarity. Get started with HSBC Future Planner today via the HSBC Singapore app.

5 key elements to financial planning

A good plan is built upon a strong foundation and pivotal elements to guide you towards your ultimate goals. Here are 5 key elements you can focus on to shape your financial planning journey.

You can never overprepare for a rainy day, especially when it comes to protecting your family. Learn how to take proactive steps to safeguard your finances and set your loved ones up for a sound future, come what may.

A good education opens the door to a better life for your children. See what financial planning can do to chart out their future, even as you chart out yours.

It's never too early to start planning for your golden years. Find out how to make the lifestyle you'd want to lead after you retire a reality.

Managing your finances for tomorrow starts today. Kick start that journey now with our suite of wealth management products.

The hard work you put in today will build a legacy you'll get to share with your loved ones some day.

Exclusively for HSBC Premier customers with access to Premier Elite service, find out how you can leave your mark and distribute your wealth just the way you'd want to.

Tools to help with your financial planning

What you'll get during your financial planning review

When you schedule your financial planning review, we'll contact you to confirm the details we have on hand, the documentation you'll need to bring, as well as notify you of the appointment time and branch location.

The session should last approximately 40 minutes and will include an in-depth review of these key areas:

Comprehensive financial needs analysis

Our Wealth Relationship Manager or specialist will take the time to develop a clear understanding of your individual needs and personal investment mindset. They'll begin by taking a holistic look at your finances before discussing your specific goals. Is it building a sizable amount of savings? Is it focusing on boosting your investment portfolio, or do you want to plan for retirement? Establishing your goals will also provide a clearer idea of your risk appetite.

Risk profiling questionnaire

The risk profiling questionnaire is designed to help you understand your risk appetite and investment needs more comprehensively, and to serve as a reference for when you make your own investment decisions. Your profile will be generated based on your response to these questions, which will give us insight into your risk tolerance levels and personal investment history.

Suitability

Taking your risk appetite, current financial situation, personal aspirations and other relevant factors into account, our Wealth Relationship Managers or specialists will carefully examine your current financial portfolio and help you identify suitable investments and insurance plans to meet your financial goals.

Tailor-made wealth solutions

Whether you're enhancing your existing investment portfolio or building a completely new one, our Wealth Relationship Managers or specialists will provide recommendations to you based on the financial needs analysis and your risk appetite. The next step after this will involve a comprehensive discussion about the wealth management solutions that you may choose to help you achieve your financial goals. We'll help get you sorted, so you can start on your personalised investment journey as soon as possible.

Your journey doesn't stop there

Even after we work with you to develop your wealth planning strategy, we're far from being done! Your needs are always evolving, so your investment portfolio deserves constant analysis and evaluation to ensure it stays aligned with your changing goals.

Our Wealth Relationship Managers and specialists will always go the extra mile for you. They'll meet with you regularly so you can review your investment portfolio and make informed decisions on the best path to clinching your financial goals.

Need some financial advice?

Schedule your strategic financial planning review today.

Find out more about our wealth solutions

Benefits of HSBC Future Planner1

- Focus on what matters most

Identify and prioritise your aspirations in order of importance, from now until retirement. - Set clear targets

Know exactly how much you need for each aspiration so you can plan accurately and take decisive next steps. - Track your goal progress

Link new fund purchases to your retirement and wealth accumulation goals so you can always stay on top of the goal progress and time to achieve them.

- Fulfil your goals

Transition from planning to investing digitally and watch your aspirations come to life. You may also consult our Relationship Managers for further guidance.

HSBC FinConnect

What is HSBC FinConnect

HSBC FinConnect is enabled by the Singapore Financial Data Exchange (SGFinDex) and lets you view your personal financial data, including information from other banks, SGX CDP and Myinfo securely in the HSBC Singapore app.

With HSBC FinConnect, you can get a clear overview of your money and investments, which makes it easier to map out and work towards your financial goals.

Key features include:

- Assets view: Check your linked banks and SGX CDP account balances in one place

- Liabilities view: Keep track of your loans, borrowing and credit cards

- Automatic calculation of your total net worth

- See your Myinfo data including CPF accounts, HDB loans and more

- Filter your finances by account type or currency

- Portfolio analysis: Understand your portfolio composition by asset class, geographies and sectors

- Option for a detailed portfolio analysis from a Wealth Manager or your dedicated Relationship Manager

Note

- Please note the tool and calculations are designed for use in Singapore. If you are outside Singapore, we may not be authorised to offer or provide you with the products and services through this tool in the country or region you are located or resident in. Any products and services represented within this tool are intended for Singapore residents. This tool and its contents do not constitute an offer of, or advice or recommendation on, financial products by HSBC Singapore. The results and/or estimates generated by this simulator tool are based on the information provided by you (including your preferred risk level) and are intended to be used for illustrative purposes only.