Security token - general questions

Questions about your security token? Well, you're in the right place. You'll find information on how to activate and use your Security Device or Digital Secure Key, as well as some troubleshooting tips.

What type of security token are you using?

There are currently two types of security token.

Digital Secure Key questions

Contents

General questions

What is a Digital Secure Key?

Digital Secure Key is a digital version of your physical Security Device that can be accessed from your HSBC Singapore app and it replaces your physical Security Device. Its functions include generating a unique, one-time use security code for logging onto Online Banking and accessing to the full range of online banking services while providing extra protection for your transactions.

Digital Secure Key works as part of the HSBC Singapore app which supports various operating systems and devices. Once you activate your Digital Secure Key you can access anytime without needing to carry a physical Security Device anymore.

Why do I need to set up the Digital Secure Key?

We encourage you to set up your Digital Secure Key as soon as possible as we will no longer be issuing a new/replacement physical Security Device. Digital Secure Key is more convenient as it is accessed via HSBC Singapore app and you do not need to carry an additional piece of device.

What will happen to my physical Security Device once my Digital Secure Key is activated? Can I continue to use my physical Security Device after activating Digital Secure Key?

Once your Digital Secure Key has been activated, your physical Security Device will be deactivated immediately. Given the size of the token, it is safe to dispose it in a regular non secured e-waste bin.

Can I continue to use my physical Security Device after activating Digital Secure Key?

No, each customer can only have 1 token – either a physical Security Device or a Digital Secure Key. Your physical Security Device will be deactivated immediately when you activate your Digital Secure Key in the HSBC Singapore app.

What if I don't think Digital Secure Key is secure enough?

We fully understand your concerns. You can rest assured that Digital Secure Key is completely secure. It is built with advanced security and protection features. To use Digital Secure Key, you will be required to authenticate yourself each time by either providing your 6-digit PIN or biometrics (Face ID / Touch ID / Fingerprint ID). Once you have activated Digital Secure Key on your device, your Digital Secure Key is linked to your personal accounts, and only you can access your accounts through your Digital Secure Key-linked device. Other users cannot log on to their HSBC Singapore app using your Digital Secure Key-linked device.

Can I set up Digital Secure Key on more than one device?

From 18th July 2021 onwards, you will not be able to set up Digital Secure Key on more than 1 device. Existing customers who have set up Digital Secure Key on more than 1 mobile device will still be able to use it on their devices.

I am a new customer. Can I opt out of Digital Secure Key and get a physical Security Device?

We encourage all customers to use the Digital Secure Key as it is an easier and safer way to log on and bank online. We will not be issuing physical Security Device to all new customers from 21 Oct 2020, unless you do not have a smartphone. If for some reason, you are not able to use Digital Secure Key please contact us so we can assist you further.

Setting up your Digital Secure Key

I would like to activate my Digital Secure Key. What do I do?

You can download or update to the latest version of the HSBC Singapore app. Follow the onscreen instructions and your Digital Secure Key will be activated.

I do not have a physical Security Device. Can I activate Digital Secure Key?

Yes you can activate your Digital Secure Key by downloading the latest version of the HSBC Singapore app and follow the onscreen instructions.

For new to HSBC customers after October 21, 2020, your Digital Secure Key will be automatically activated upon successful set-up of the latest HSBC Singapore app in your mobile device.

When I am prompted to activate Digital Secure Key, can I choose not to proceed and continue to use physical Security Device with HSBC Singapore app?

The option to activate Digital Secure Key at a later time is only offered to existing customers who have already set up the HSBC Singapore app and have an active physical Security Device. Skipping the activation of Digital Secure Key is offered for a limited period only and you may continue using your existing physical Security Device with the HSBC Singapore app during this period. Further communication will be sent by the bank once you need to activate Digital Secure Key to continue using your HSBC Singapore app.

For all other customers, you will not be able to access the HSBC Singapore app if you choose to continue using the physical Security Device. To use the HSBC Singapore app, you will need to switch to Digital Secure Key when prompted to and your physical Security Device will be deactivated.

For new to HSBC customers downloading our HSBC Singapore app after October 21, 2020, your Digital Secure Key will automatically be activated upon successful set up of the HSBC Singapore app.

If for some reason, you are not able to use the Digital Secure Key, please contact us so we can assist you further.

How can I set up my Digital Secure Key on a new mobile device if I already have a Digital Secure Key on another device?

To use your Digital Secure Key with your new mobile device, you first need to unlink the HSBC Singapore app from your old one. To do this, log on to the HSBC Singapore app on your old device and go to Profile icon on top right of app screen > Security > Manage Devices. Find your old device and tap 'Remove this device'. You can then activate your Digital Secure Key on your new mobile device by using your online banking password and verifying it with an SMS OTP.

If you have forgotten your password when you're setting up your new device, you will need to reset your password first via Online Banking.

If you have not set-up a password yet, please contact us and request a physical Security Device. Once you receive this, you may contact us again or proceed to any branch to activate the physical Security Device. Using this physical Security Device, you can log on to Online Banking and set up a password. You can then set up your Digital Secure Key on the HSBC Singapore app using the newly created password and SMS OTP.

I have a new mobile device. Can I use Digital Secure Key on my new device?

To use your Digital Secure Key with your new mobile device, you first need to unlink the HSBC Singapore app from your old device. To do this, log on to the HSBC Singapore app on your old device and go to Profile icon on top right of app screen > Security > Manage Devices. Find your old device and tap 'Remove this device'. You can then activate your Digital Secure Key on your new mobile device by using your online banking password and verifying it with an SMS OTP.

Note: If this is your first time to download HSBC Singapore app, please ensure you have your Online Banking password to set it up successfully.

If you have not set-up a password yet, please contact us and request a physical Security Device. Once you receive this, you may contact us again or proceed to any branch to activate the physical Security Device for you. Using this physical Security Device, you can then log on to Online banking and set up a password. You can then set up your Digital Secure Key on the HSBC Singapore app using the created password and SMS.

I have deleted my app with Digital Secure Key, but when I download the app on the same device and input my username, it's asking me to set up with password again. What if I don't remember my password or I don't have a password?

Please go to Online Banking and choose to log on with Password. On password input screen, you can follow the Forgotten Password link to reset your password. With the new password, you can set up Digital Secure Key on the mobile app again.

If you did not set up a password previously, please contact us and request a physical Security Device. Once you receive this, contact us or proceed to any branch to activate the Security Device for you. Using this Security Device, you can log on to Online banking and set up a password for future use. You can then either set up a Digital Secure Key on the HSBC Singapore app using either password and SMS, or continue using the Physical Security Device.

I have contacted your hotline after I had issues using the Digital Secure Key. They sent me a new physical Security Device as a replacement. What do I do next?

First you need to log on to the HSBC Singapore app with your Digital Secure Key, go to Profile icon on top right of app screen > Security > Manage Devices > remove all devices listed, ending with the one you are currently using. If you have problem doing that, please contact us for help.

Next, log on to online banking on your PC/laptop using your username and password and follow onscreen instructions to activate your new physical Security Device.

Using and troubleshooting your Digital Secure Key

What if I forget my 6-digit PIN to access my Digital Secure Key?

You can reset the 6-digit PIN by providing your password and a one-time SMS code. Simply follow the "Forgotten your PIN?" link on the log on page of the app. Please note that you need to have a valid mobile phone number that is in our records in order to receive the one-time SMS code to reset your 6-digit PIN.

What should I do if I lose my phone?

If you have the HSBC Singapore app set up on another mobile device, please log in to the app on that device and go to Profile icon on top right of app screen > Security > Manage devices > find the lost device in the list and select "Remove device".

If you have not set up the HSBC Singapore app on another mobile device, please contact us to report the lost device so we can de-link your device from your profile.

Can the Digital Secure Key be used if I'm overseas and my phone does not have internet access?

Yes the Digital Secure Key can be used offline to generate security codes. You can launch your HSBC Singapore app, and tap on the button "Return to log on" and once you're at the home page, tap on "Generate security code".

I have entered the correct 6-digit PIN or used biometrics to generate a security code, but I'm getting an error that this is invalid. I know I have used the correct 6-Digit PIN/my biometrics was accepted – why am I getting this error?

One of the possible reasons for this error is that the device time is not auto-retrieved from the network provider. Please ensure this is enabled on your device. Go to your mobile device settings and set the time to automatically retrieve from your network provider.

If in case this does not solve the issue, please contact us to assist you further.

Can I choose to switch back to a physical Security Device if I don't like using Digital Secure Key?

Only customers who are unable to use Digital Secure Key can apply for a physical Security Device. You may contact us for further details.

Security Device

Contents

Getting your Security Device

What is a Security Device?

A Security Device is a small, portable electronic device, which generates random security codes for one-time use, required to log on and transact on Online Banking.

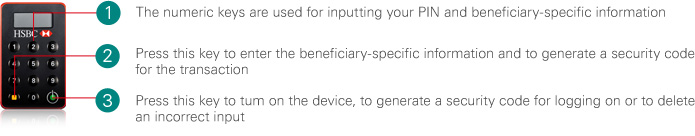

Your Security Device provides Online Banking users an additional layer of security to protect against fraudulent transactions. This requires you to:

- Key in beneficiary-related information on the device for every transaction

- Generate a unique security code on the device to authorise each transaction

Your Security Device is PIN-protected

Your Security Device is unique as it is PIN-protected. You will have to set a PIN during activation and this PIN will be required to unlock the device before each use.

What is a security code?

A security code is a single-use random number generated by the Security Device. The security code is to be used together with your username and password when accessing Online Banking. It will also be required for third party fund transfers, bill payments and updating of your details on Online Banking.

What is a serial number?

The serial number is a unique 10-digit number used to identify your individual Security Device. It is located at the back of your Security Device in the format of XX-XXXXXXX-X where X is a number (e.g. 12-3456789-0). This number also helps with identification in the case of multiple Security Devices in a household or company and should not be removed.

Are there any risks associated with the serial number on the Security Device being visible?

The serial number is used to identify which Security Device is associated with a specific customer and is only required for the activation process. There is no risk associated with the serial number being visible.

I have just registered for Online Banking, but do not have my Security Device yet. When will I receive my Security Device?

You can download the HSBC Singapore app and activate your Digital Secure Key immediately, allowing you to generate security codes and access the full range of online and mobile banking services.

If you have requested for a Security Device, please allow up to 5 working days (for Singapore mailing address), or up to 12 working days (for overseas mailing address) for it to be mailed to you.

Setting up your Security Device

I have just received my Security Device. How do I activate it?

Once you have registered for Online Banking and received the Security Device, follow below instructions to activate your Security Device.

- Log on to your Online Banking

- When prompted with the pop-up, scroll down and expand "Don't have compatible device" section.

- Click on "Activate now" and proceed to follow the onscreen instructions.

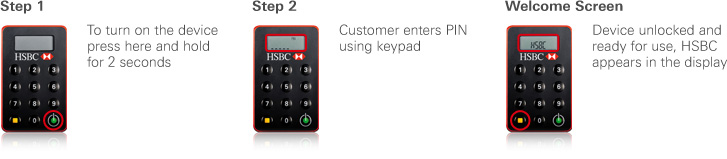

How do I turn on my new Security Device?

Please follow the steps below:

Watch our video to see how to activate your Security Device.

Why do I see a 'FAIL 1', 'FAIL 2' or 'FAIL 3' message on the device?

This is because the PIN entered is incorrect. Press the green button to re-enter your PIN. You will have a total of 3 attempts to enter a correct PIN before the device is locked.

Why do I need to set up a PIN for the new Security Device?

The HSBC Security Device is unique as it is PIN-protected. For added security, you will have to set a PIN during activation and this PIN will be required to unlock your device before use.

How many digits can I choose for the PIN?

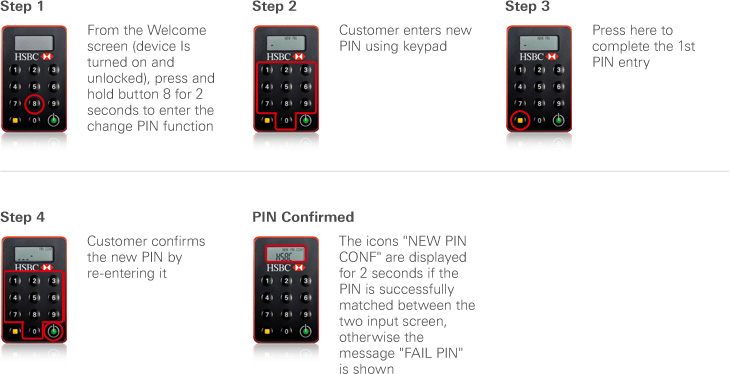

You can only choose a 6-digit PIN for the new device.

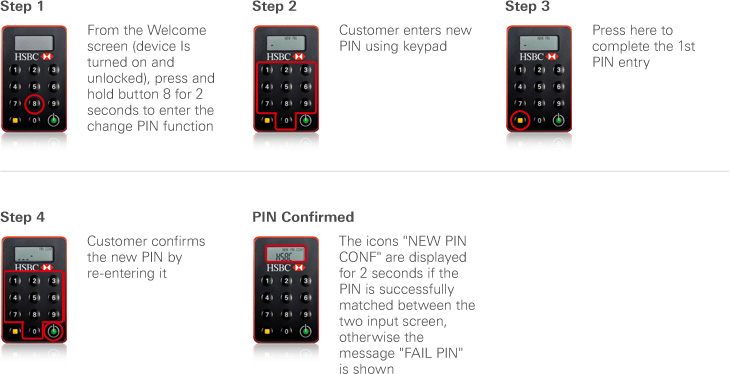

How do I set up a new PIN?

Please follow the steps below:

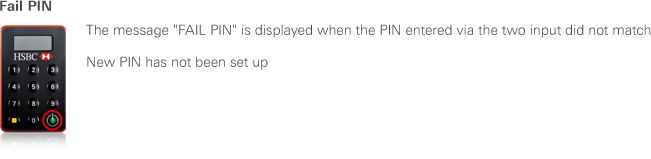

What happens if my PIN setup is unsuccessful?

A message 'FAIL PIN' will be shown on the device, reflecting that your confirmation PIN did not match the first PIN entered. You will need to restart the PIN setup process by pressing the green button.

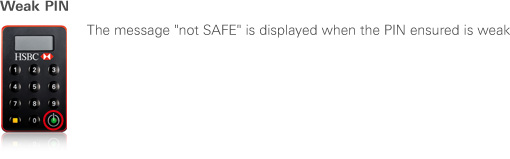

Why do I see a message 'NEW PIN NOT SAFE' on the device?

This means that the new PIN that you have entered is not safe and could be guessed, ie repeating or sequential numbers (eg 111111, 123456, 543210). Please restart the PIN setup process and choose another 6-digit PIN.

Why do I need to call customer service to activate my Security Device?

You are given up to 30 days to activate your Security Device. After this period, you need to call our customer service to activate your Security Device.

You can still logon to Online Banking using your username and your existing password in full as this is an alternative way of logging in to your Online Banking account. However, you are required to log in with your Security Device to access certain features.

Using your Security Device

How do I use my Security Device to log on?

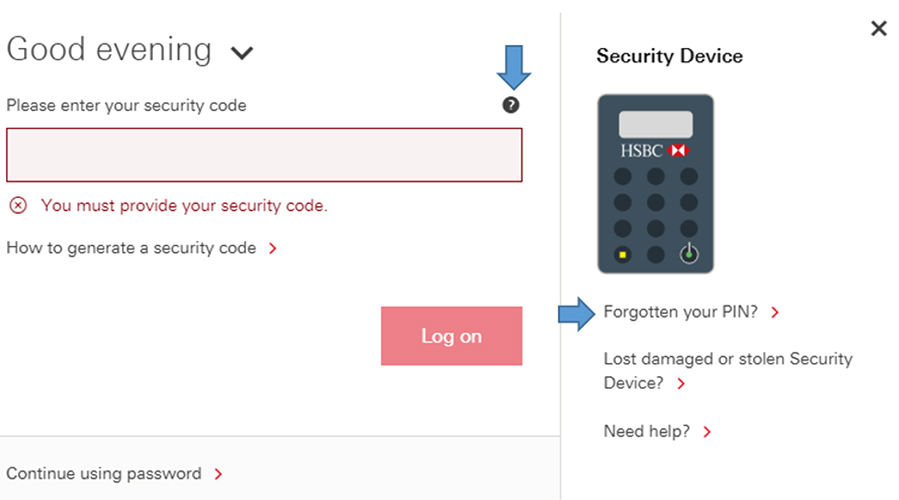

What should I do if I forget my PIN for the Security Device?

Please follow the steps below:

- Go to the Online Banking logon page, enter your username and click "continue".

- Click ? above the security code field.

- Click "Forgotten your PIN" link.

- Follow the on-screen instructions.

How do I change my PIN for the device?

Please follow the steps below:

What should I do if I have entered a wrong number into my Security Device during the authorisation process?

If you have entered a wrong number into your Security Device, press the green button to backspace and delete your last entry. To clear your entire entry, press and hold the same green button.

What should I do if I am overseas and did not receive the SMS OTP for Security Device Activation?

An SMS OTP will be sent to the mobile number on our records in order to activate your Security Device. This mobile number will be partially masked on the SMS OTP verification page. Please ensure that this mobile number is correct and up to date. In case you need to update your mobile number, please visit an HSBC Branch or update via one of the ways below:

For customers with Singpass access, you can update your contact details at Personal contact details update using Myinfo (For Singpass users only).

For customers residing Singapore, please download the Update personal particulars and contact details form (PDF) and mail it to us using the Business Reply Envelope.

For customers residing overseas, please download the Update personal particulars and contact details form (overseas) (PDF) and mail it to us using the Business Reply Envelope.

How long will the battery of the Security Device last?

The Security Device is battery-powered with a lifespan between three to five years, depending on the frequency of the usage. You will be prompted with a "BATT#" message when the battery of your security device is running low.

Do I have to provide replacement battery for my Security Device?

No, the battery in the Security Device cannot be replaced. Your Security Device will provide warning that the battery is running low on power. You will then need to contact us to get a replacement device.

Replacing or upgrading your Security Device

What should I do if my Security Device is lost or stolen?

You should inform us to de-activate your lost or stolen Security Device immediately.

For Online Banking Users, please call our 24-hour customer service hotline on 1800-HSBC NOW (4722 669) in Singapore or (65) 6-HSBC NOW (4722 669) from overseas.

What should I do if I want to replace my Security Device?

We encourage all customers to use the Digital Secure Key, which is available via the HSBC Singapore app. If you are unable to use the Digital Secure Key, you can request for a replacement Security Device by visiting a branch or contacting us.