Make the most of your money

Looking to invest or set aside some foreign currency to use in the future? Our Foreign Currency Time Deposit Account can help. Make a deposit in any of the 10 supported currencies, then choose a tenure from 1 to 12 months.

How it works

Even if you don't need the foreign currency right away, you can buy it while the exchange rate is favourable to you. Next, put it into an HSBC Foreign Currency Time Deposit to earn interest on it.

When it matures, you can withdraw it to invest, travel or pay for your children's overseas education. If you don't need the money right away, you can leave the time deposit to be renewed so you can continue to earn more interest.

- Earn interest at competitive rates – you might make capital gains if the exchange rates move in your favour[@accounts-fx-actual-returns]

- Place deposits by cash, cheque, demand draft or telegraphic transfers; and choose from a wide range of withdrawal options

- Renew your time deposits automatically, withdraw interest, and more

Time Deposit Promotions

From now till 28 February 2026, enjoy promotional rates[@usd-time-deposit-promotion-terms] on 3-month, 6-month and 12-month USD Time Deposits with a minimum deposit of USD30,000 in fresh funds. Please refer and make your placement on the HSBC Singapore App for applicable promotional time deposit interest rates ("Promotional Rate").

For placements that are not made through the HSBC Singapore App, please visit us at our branches or contact your Relationship Manager. The applicable Promotional Rates are as follows.

| Tenure | Placement amount | Promotional rate |

|---|---|---|

| 3-month | USD100,000 and above | 4.08% p.a. |

| 3-month | USD30,000 to <USD100,000 | 3.55% p.a. |

| 6-month | USD30,000 and above | 3.40% p.a. |

| 12-month | USD30,000 and above | 2.70% p.a. |

| Tenure | 3-month |

|---|---|

| Placement amount | USD100,000 and above |

| Promotional rate | 4.08% p.a. |

| Tenure | 3-month |

| Placement amount | USD30,000 to <USD100,000 |

| Promotional rate | 3.55% p.a. |

| Tenure | 6-month |

| Placement amount | USD30,000 and above |

| Promotional rate | 3.40% p.a. |

| Tenure | 12-month |

| Placement amount | USD30,000 and above |

| Promotional rate | 2.70% p.a. |

| Tenure | Placement amount | Promotional rate |

|---|---|---|

| 3-month | USD100,000 and above | 4.08% p.a. |

| 3-month | USD30,000 to <USD100,000 | 3.55% p.a. |

| 6-month | USD30,000 and above | 3.40% p.a. |

| 12-month | USD30,000 and above | 2.70% p.a. |

| Tenure | 3-month |

|---|---|

| Placement amount | USD100,000 and above |

| Promotional rate | 4.08% p.a. |

| Tenure | 3-month |

| Placement amount | USD30,000 to <USD100,000 |

| Promotional rate | 3.55% p.a. |

| Tenure | 6-month |

| Placement amount | USD30,000 and above |

| Promotional rate | 3.40% p.a. |

| Tenure | 12-month |

| Placement amount | USD30,000 and above |

| Promotional rate | 2.70% p.a. |

| Tenure | Promotional rate |

|---|---|

| 3-month | 3.05% p.a. |

| 6-month | 2.90% p.a. |

| 12-month | 2.20% p.a. |

| Tenure | 3-month |

|---|---|

| Promotional rate | 3.05% p.a. |

| Tenure | 6-month |

| Promotional rate | 2.90% p.a. |

| Tenure | 12-month |

| Promotional rate | 2.20% p.a. |

| Tenure | Promotional rate |

|---|---|

| 3-month | 3.00% p.a. |

| 6-month | 2.85% p.a. |

| 12-month | 2.15% p.a. |

| Tenure | 3-month |

|---|---|

| Promotional rate | 3.00% p.a. |

| Tenure | 6-month |

| Promotional rate | 2.85% p.a. |

| Tenure | 12-month |

| Promotional rate | 2.15% p.a. |

Things you need to know

Are you eligible?

To open an HSBC Foreign Currency Time Deposit Account, you'll need an HSBC deposit account first.

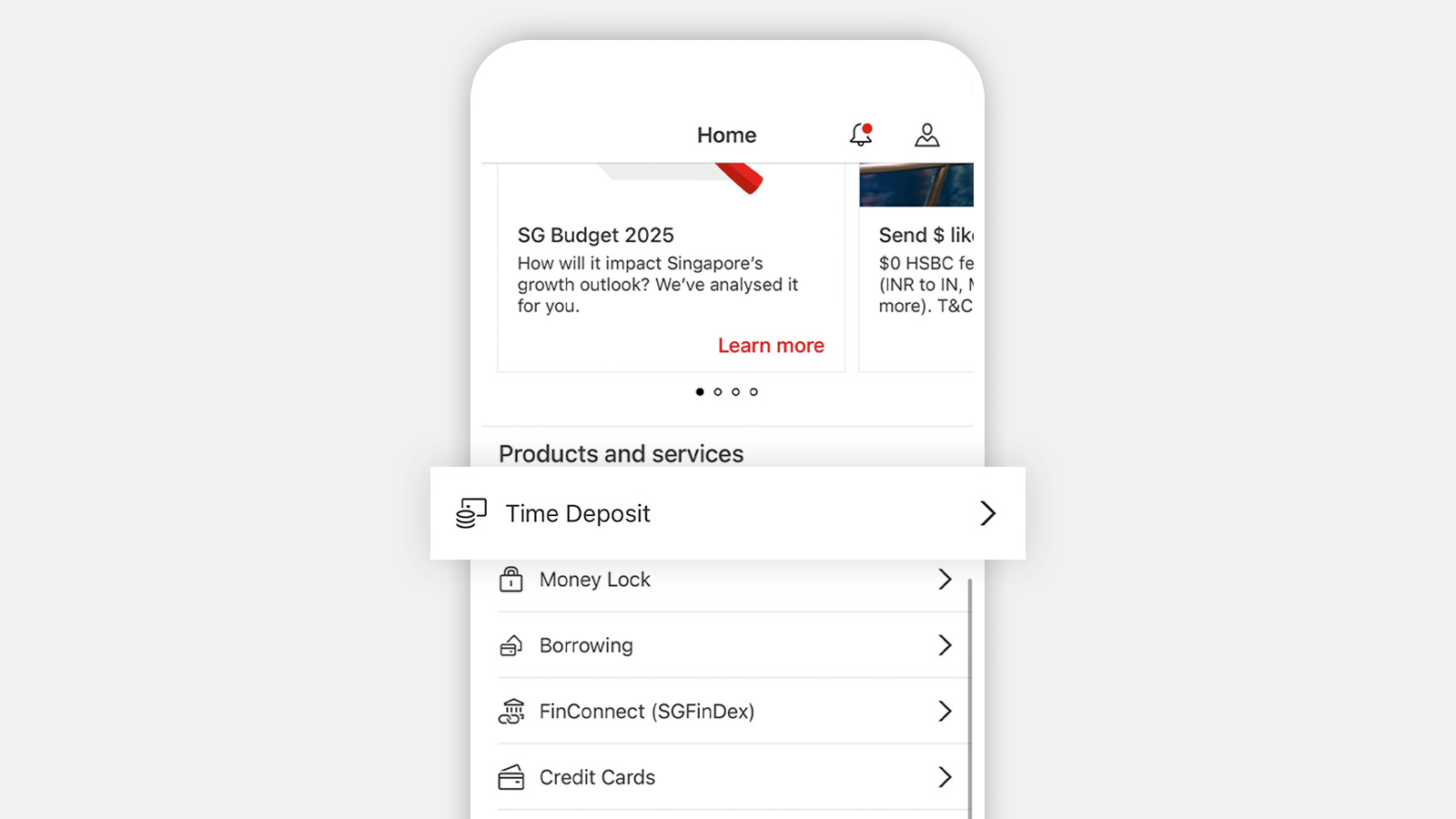

How to apply via the HSBC Singapore app

The easiest way to open an account

- Select 'Time Deposit' on the 'Home' tab

- Choose your debiting account, deposit amount, currency, tenure and maturity instructions - you'll then see the interest rate, interest amount and what you'll receive at the end of your term

- Select 'Continue' and open your account

Ready to get started?

New to HSBC and living in Singapore?

You can apply for an Everyday Global Account (EGA) first via the HSBC Singapore App if you don't already have a credit card, bank account, mortgage or insurance with us.

Scan the QR code to apply.

Already an HSBC customer?

Log on to the HSBC Singapore App or Online Banking to make a deposit.

Other ways to apply

You might also be interested in

Important notes

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation for up to S$100,000 in aggregate per depositor per scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.