5 Things You Didn’t Know About Debt Consolidation

In 2017, an average of 4,000 Singaporeans every month hit unsecured debt levels 12 times their monthly income or more. That may just be a fraction of Singapore’s 1.5 million unsecured credit users, but it’s still a troubling figure. If you happen to (reluctantly) count yourself among those ranks, you may be struggling with too many bills, high interest charges and making prompt debt repayments.

Here’s where a debt consolidation plan (DCP) may be useful. If you’ve never heard of it, we don’t blame you; DCPs have only been rolled out in Singapore last year, and its name – debt consolidation plan – is quite a mouthful. However, utilised properly, a DCP can be a powerful tool for helping you clear off high-interest debt. Here are 5 things you may not know about debt consolidation:

1. What exactly is debt consolidation?

Consolidation is just a fancy word that refers to the action of combining things together, usually into something that’s more effective. Debt consolidation, therefore, just means the act of combining your debts.

A DCP helps you combine all your unsecured credit facilities (such as credit cards and personal loans) from different institutions into a single loan. Instead of struggling to keep track of several different loan types, interest rates and due dates, you get to simplify the debt repayment process by putting it all in one loan.

2. A debt consolidation plan can help you get lower interest rates

While taking on another loan to pay off existing debts may seem counterintuitive, a major advantage of a DCP is that you’ll get to consolidate your debts at a much lower interest rate. For example, HSBC’s Debt Consolidation Plan offers an effective interest rate (EIR) of 8.5% p.a. – 10% p.a., which is far lower than the 24% p.a. – 27% p.a. interest rate charged by most credit cards in Singapore.

| Unsecured credit facility |

Outstanding balance |

Interest rate (p.a.)1 |

Monthly repayment |

|---|---|---|---|

| Credit Card 1 |

SGD18,000 |

25.5% |

SGD602 |

| Credit Card 2 |

SGD11,000 |

25.9% |

SGD370 |

| Credit Card 3 |

SGD9,000 |

26.9% |

SGD308 |

| Personal Loan (4 years) |

SGD12,000 |

11% |

SGD310 |

| Total monthly repayment |

SGD1,590 |

SGD1,590 |

SGD1,590 |

| Unsecured credit facility |

Credit Card 1 |

|---|---|

| Outstanding balance |

SGD18,000 |

| Interest rate (p.a.)1 |

25.5% |

| Monthly repayment |

SGD602 |

| Unsecured credit facility |

Credit Card 2 |

| Outstanding balance |

SGD11,000 |

| Interest rate (p.a.)1 |

25.9% |

| Monthly repayment |

SGD370 |

| Unsecured credit facility |

Credit Card 3 |

| Outstanding balance |

SGD9,000 |

| Interest rate (p.a.)1 |

26.9% |

| Monthly repayment |

SGD308 |

| Unsecured credit facility |

Personal Loan (4 years) |

| Outstanding balance |

SGD12,000 |

| Interest rate (p.a.)1 |

11% |

| Monthly repayment |

SGD310 |

| Unsecured credit facility |

Total monthly repayment |

| Outstanding balance |

SGD1,590 |

| Interest rate (p.a.)1 |

SGD1,590 |

| Monthly repayment |

SGD1,590 |

Your total monthly repayment would amount to SGD1,590 – about 40% of your salary. Clearing off your debts in 4 years would mean paying a total of SGD26,334.76 in interest on top of your principal.

| Terms | Existing debt |

Debt Consolidation Plan |

|---|---|---|

| Total outstanding balance |

SGD50,000 |

SGD52,500 (including 5% allowance3) |

| Interest rate2 |

25.5% p.a. 25.9% p.a. 26.9% p.a. 11% p.a. |

8.5% p.a. |

| Total monthly repayment |

SGD1,590.25 |

SGD1,294.04 |

| Total interest payable (over 4 years) |

SGD26,334.76 |

SGD9,613.72 |

| Interest savings |

- | 63% |

| Terms |

Total outstanding balance |

|---|---|

| Existing debt |

SGD50,000 |

| Debt Consolidation Plan |

SGD52,500 (including 5% allowance3) |

| Terms |

Interest rate2 |

| Existing debt |

25.5% p.a. 25.9% p.a. 26.9% p.a. 11% p.a. |

| Debt Consolidation Plan |

8.5% p.a. |

| Terms |

Total monthly repayment |

| Existing debt |

SGD1,590.25 |

| Debt Consolidation Plan |

SGD1,294.04 |

| Terms |

Total interest payable (over 4 years) |

| Existing debt |

SGD26,334.76 |

| Debt Consolidation Plan |

SGD9,613.72 |

| Terms |

Interest savings |

| Existing debt |

- |

| Debt Consolidation Plan |

63% |

2Interest rates are based on general product offerings in Singapore. Actual figures may vary.

3The 5% allowance is provided to cover any incidental charges (e.g. interest and fees payable) incurred.

These figures are for illustrative purposes only.

In the example above, consolidating your debts can save you SGD16,721.04 in interest payment – that’s a saving of 63%!

Another benefit of a lower interest rate is that it helps you pay down your debt faster. This is because the money you’ve saved by paying less interest can be used to increase the monthly repayments of your DCP, shortening your loan tenure.

3. You can select your loan tenure under a debt consolidation plan (within limits)

The minimum monthly payment for most credit cards in Singapore is 3% of the outstanding balance. If you don’t pay the required amount, you can be charged with late payment fees. This can create a vicious cycle of debt if you cannot afford to meet the minimum monthly payments.

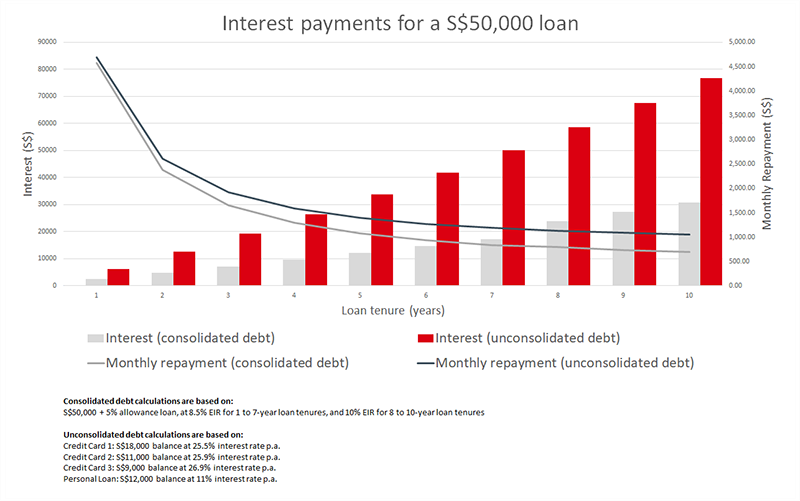

In contrast, if you consolidate your debts under a DCP, you can choose your preferred loan tenure to make monthly payments more manageable. HSBC’s Debt Consolidation allows you to set a loan tenure from 1 year to 10 years, with an EIR of 8.5% p.a. for 1 to 7-year loan tenures, and an EIR of 10% p.a. for 8 to 10-year loan tenures. The longer your loan tenure, the lower your monthly repayment amount.

However, a longer loan tenure means that you will be paying more interest over time. If you can afford to make higher monthly repayments, you should do so to avoid higher interest charges. Here are the estimated interest payments and monthly instalments you may incur for the following loan tenures under a DCP, compared to those incurred by unconsolidated debt.

*This graph is based on the calculations above. These figures are for illustrative purposes only.

4. You cannot use your existing unsecured credit facilities during or after an application for a debt consolidation plan

When you apply for a DCP, please do not use your existing unsecured credit facilities as this additional amount utilised will not be consolidated. Once your DCP application is approved, all your existing unsecured credit facilities will be closed or suspended.

However, under HSBC’s Debt Consolidation Plan, you will be given a revolving credit facility in the form of the HSBC Visa Platinum Credit Card to help you manage your daily expenses. You won’t have to pay this card’s annual fee, as long as it remains under the DCP. The limit of the revolving credit facility will be fixed at one time your monthly income. Of course, you can choose not to use the full limit, or choose not to use the facility at all.

5. A debt consolidation plan can be a powerful tool for helping you clear off debt, but it’s not right for everyone

Not everyone with debt will automatically qualify for a DCP. To be eligible, you must:

- Be a Singapore Citizen or Permanent Resident;

- Earn between SGD30,000 and below SGD120,000 per annum; and

- Have total interest-bearing unsecured debt on all credit cards and unsecured credit facilities with financial institutions in Singapore that exceeds 12 times your monthly income.

If you meet the requirements above, here’s another critical question you’ll have to consider before taking up a DCP: Will you be able to stay-debt free after successfully paying off your debt consolidation loan?

Staying out of debt doesn’t just mean clearing off existing debts – it involves changing your spending habits that got you into debt in the first place. It won’t make sense to take on a loan to pay off existing debts, only to pile them on again after your loan has been cleared. If you don’t plan on changing your spending habits, taking on a DCP will only extend your financial woes. On the other hand, if you’re ready to make changes in your budget and stick to them, a DCP may help you through the process of becoming debt-free.

What’s next?

Do a bit of housekeeping – find out how much you owe, and how much it’s costing you every month. If you have substantial high-interest debts or struggle with making monthly repayments, a DCP may be a good option to help you cope.

If you’re struggling with debt, don’t be afraid of reaching out for help – being debt-free is too important to let shame or embarrassment get in the way. Take charge of your finances with HSBC’s Debt Consolidation Plan now.

Sources: