16 December 2025

China’s Central Economic Work Conference (CEWC), held on 10–11 December, reviewed the year’s economic performance and set priorities for 2026. The conference emphasized progrowth strategies, focusing on high-quality development through consumption, technology, and green initiatives, aiming to ensure a strong start to the 15th Five-Year Plan.

The CEWC provided clarity on several points not addressed in the December Politburo meeting. Notably, the main priority for 2026 will be on strengthening domestic demand through increased consumption and investment, supported by new policy financing tools and urbanisation projects. The urgency around stabilising the property sector was more pronounced, reflecting recent market declines. Additionally, the anti-involution campaign was referenced, signalling the potential introduction of targeted policies to address supply demand imbalances.

The conference reaffirmed a proactive fiscal approach, maintaining a fiscal deficit target of 4% of GDP and supplementing this with special government bonds. Fiscal reforms will focus on improving local tax systems and restructuring local government debt, including accelerated settlement of overdue payments to enterprises. On the monetary front, the People’s Bank of China will likely keep using interest rate and reserve requirement ratio cuts, as well as structural policy instruments and government bond purchases to support growth and price recovery.

The primary focus identified by the CEWC is to stimulate domestic demand via consumption and investment. The rollout of the “special action plan to boost consumption” suggests further policy initiatives are forthcoming. Strengthening household incomes is expected to play a key role in restoring consumer confidence. Other structural measures – such as expanding social safety nets by extending employment insurance to gig workers and improving access to healthcare – can also help to unlock consumption. With over 240 million gig workers in China (NBS, 2024), expanding coverage for this group should reduce precautionary savings.

The CEWC has also highlighted the need to “unleash the potential of services consumption”, recognising that China’s services consumption as a share of GDP remains below that of many developed economies. Next year’s policies may include expanded support for the services sector, such as targeted consumption subsidies.

Investment in infrastructure and urbanisation are needed to complement rising consumption. As the 15th Five-Year Plan commences, a wave of new projects is anticipated, supported by the recent introduction of innovative financial policy tools. In October, RMB500bn in new financing instruments was issued, fully allocated across thousands of projects, potentially underpinning total investment of approximately RMB7trn.

On the property front, the CEWC emphasised the importance of stabilising the property market through city-specific policies by controlling new supply, reducing inventory and optimise housing mix, as well as converting existing commercial housing into affordable housing. This suggests a stronger stance than we expected. If the government were to make larger interventions – such as using central government funds to segregate housing assets from banks’ balance sheets and digest housing stock – this can more effectively stabilize the sector.

While anti-involution measures have received less attention recently, the CEWC reaffirmed their importance. Plans include establishing a unified national market to facilitate the free movement of production factors and reduce local protectionism, thereby promoting fair competition. The green transition remains a priority, with accelerated energy efficiency and carbon reduction initiatives, and the expansion of the national carbon emissions trading market to cover major industries by 2027, in line with 2030/2060 carbon neutrality targets.

The CEWC also highlighted continued focus on technology development, with investment in education, research, and innovation centres, alongside the rapid adoption of advanced technologies, such as AI. Despite prioritising domestic demand, China will maintain its commitment to opening up and reform, supporting economic rebalancing through increased imports and expanded overseas investment, e.g., the Belt and Road Initiative and bilateral trade and investment agreements.

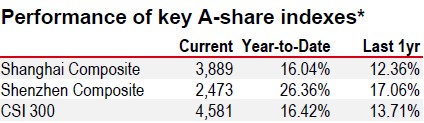

Source: LSEG Eikon

*Past performance is not an indication of future returns.

Source: LSEG Eikon. As of 12 Dec 2025, market close

Additional disclosures

1. This report is dated as at 15 December 2025.

2. All market data included in this report are dated as at close 15 December 2025, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA and The Hongkong and Shanghai Banking Corporation Limited (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. Incorporated in Hong Kong SAR with limited liability. HSBC India is an AMFI-registered Mutual Fund Distributor of select mutual funds and a referrer of other 3rd party investment products. HSBC India does not distribute or refer investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or any other jurisdiction where such distribution or referral would be contrary to law or regulation.

HSBC India will receive commission from HSBC Asset Management (India) Private Limited, in its capacity as a AMFI registered mutual fund distributor of HSBC Mutual Fund. The Sponsor of HSBC Mutual Fund is HSBC Securities and Capital Markets (India) Private Limited (HSCI), a member of the HSBC Group. Please note that HSBC India and the Sponsor being part of the HSBC Group, may give rise to real, perceived, or potential conflicts of interest.

HSBC India has a policy in place to identify, prevent and manage such conflict of interest For more information related to investments in the securities market, please visit the SEBI Investor Website: https://investor.sebi.gov.in/ and the SEBI Saa₹thi Mobile App. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Issued by The Hongkong and Shanghai Banking Corporation Limited, India. Incorporated in Hong Kong SAR with limited liability. HSBC Bank ARN - 0022 with validity from 19-Feb-2024 to 18-Feb-2027. Date of initial registration: 19-Feb-2002.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

© Copyright 2026. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.