Get extra financial flexibility

Spend Instalment helps you to stretch your budget. It gives you the flexibility of splitting large purchases - from air tickets to online shopping - into smaller monthly repayments.

Apply now on the HSBC Singapore app.

What you need to know about Spend Instalment

How it works

You can use Spend Instalment to split large transactions into regular small repayments. Example spends:

- A down payment on a car

- Electronic gadgets

- Online shopping

- Air tickets

The approved instalment amount will be divided into equal monthly instalments based on the term you select, up to a maximum of 12 months. There will be a one-time processing fee.

Please note:

- Intended transactions need to be posted by the merchant

- You should request Spend Instalment for your intended transaction before your statement billing date

Fees and charges

You'll need to pay a one-time processing fee. The amount depends on the instalment period you choose:

- 3-month period: 3%

- 6-month period: 3%

- 12-month period: 5%

As an example, let's say you bought a new laptop for SGD1,800 with your HSBC credit card. You use Spend Instalment to manage your purchase over a 12-month period. Here's how much you'll need to pay:

- One-time processing fee: SGD90 (5% of the transaction amount)

- Each monthly instalment: SGD150

Important information

Note for GIRO arrangements

Here’s what we’ll do if you have an existing GIRO (General Interbank Recurring Order) arrangement.

We'll process the deduction based on your statement account balance. Let’s say you’ve applied Spend Instalment to a transaction. If that transaction is already shown in your statement, the instalment for it will be in your next statement cycle.

Your account might show as being in credit balance in its next statement cycle. This may be due to the full transaction amount being reversed, less the instalment amount.

How to apply for Spend Instalment on the app

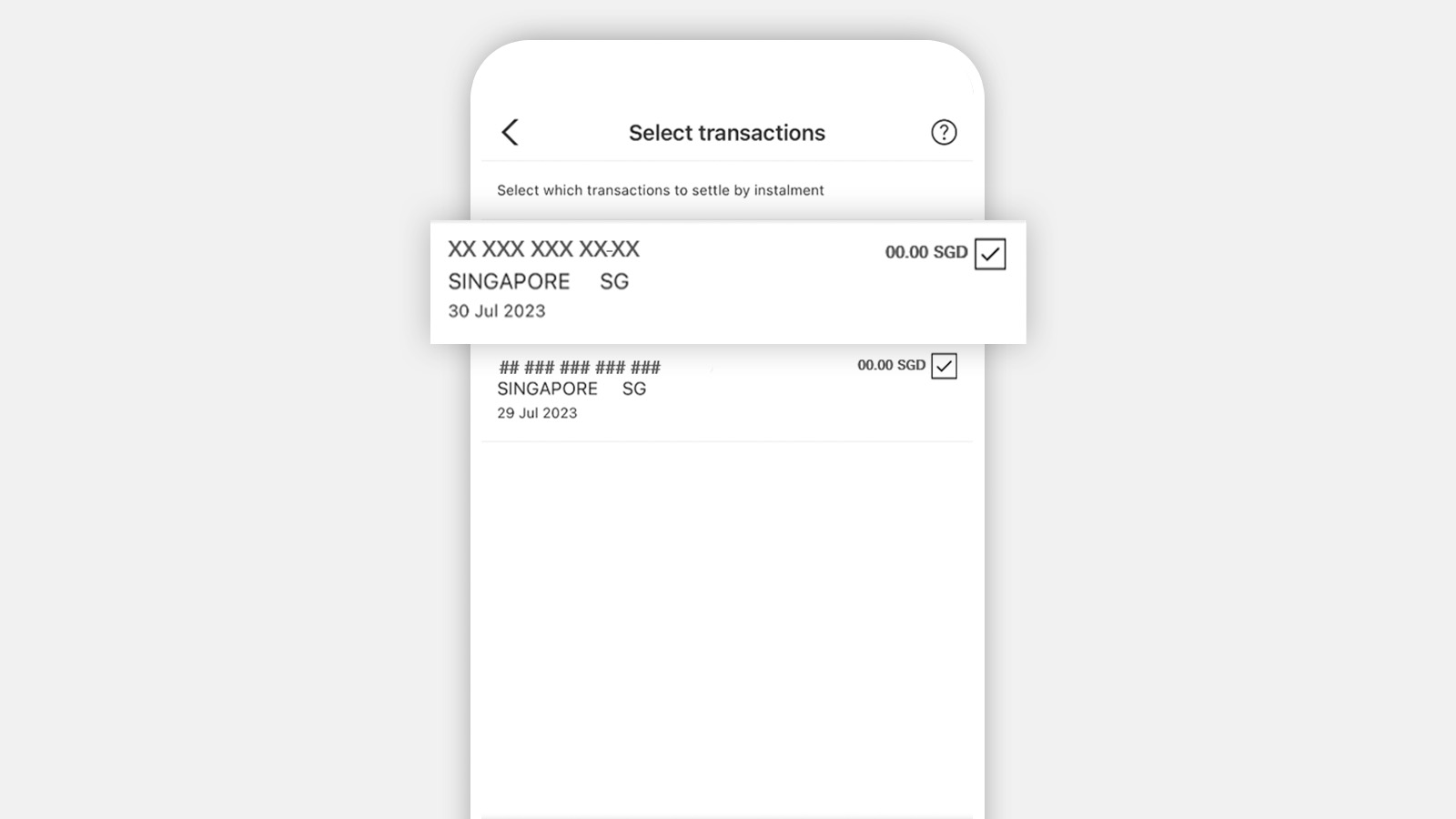

To apply, first log on to the HSBC Singapore app and select your credit card account. Then follow these steps:

Select ‘View more’ and tap on ‘Spend instalment’

Choose the transactions which you would like to convert into Spend Instalment and submit the request.

Ready to apply?

Log on to the HSBC Singapore app and apply for Spend Instalment in just a few steps.

Scan the QR code to apply.