General

How do I apply for an account with the new digital account opening journey?

If you're residing in Singapore, go to the HSBC Bank Account webpage. Find the account that you wish to open. If you meet the eligibility criteria, you can click the "apply now" button for your chosen account here.

If you're residing in another country or region outside Singapore, visit HSBC International Account Opening webpage and click the "apply now" button.

Am I eligible to open an account with the digital account opening journey?

Yes, if you meet the following criteria:

- you must have a valid NRIC, passport or MyKad (for Malaysian citizens)

- you're aged 16 years or over (for relevant products)

- you're applying for a sole account

- you don't hold any of the following:

- HSBC Current, Savings or Time Deposit Accounts

- HSBC Investment Accounts

- HSBC Credit Cards (including supplementary credit cards)

- HSBC Insurance Plan

I'm an existing HSBC customer and I want to upgrade my account. Can I do this with the new digital account opening journey?

Please call your Relationship Manager or your corresponding branch for your upgrade options.

You can also call our customer service hotline on 1800-HSBC NOW (4722 669) to find out more.

I am an existing HSBC customer and I want to open a new Everyday Global Account (EGA). Can I do this with the new digital account opening journey?

To open a new EGA account, simply log on to Online Banking.

Go to "Account services" under the navigation bar at the top of the page. Select "Open new Everyday Global Account". If the application is submitted before cut-off, it'll take the bank approximately 2 days to process your application.

If you don't have access to Online Banking, please follow the steps here to register.

I used to have accounts or cards with HSBC but I have closed them all. Can I use this service?

Yes. As long as you don't currently have any accounts (e.g. Current, Savings or Time Deposit Accounts) or credit cards with us and you meet the respective eligibility requirements, you can use the new digital account opening journey to open a new account.

How do I activate my debit card?

You can follow the steps below to activate your debit card:

- Call in to 1800-HSBC NOW or (65) 64722 669 if you are overseas.

- Select '*', then select '4' for 'card activation'.

- Enter the one time password (OTP) that's sent to your registered mobile number.

How long does it take to complete the whole journey?

It takes around 15 minutes to complete the digital account opening form.

We may contact you for supporting documents and/or ID verification. The debit card, and PIN will be sent by post to your residential address in 3-6 business days.

What document is required to upload in the digital account opening journey?

We require different documents to be uploaded subject to your application status. You will be able to find out the document requirement and instructions on the digital account opening form.

What's different when applying with Myinfo?

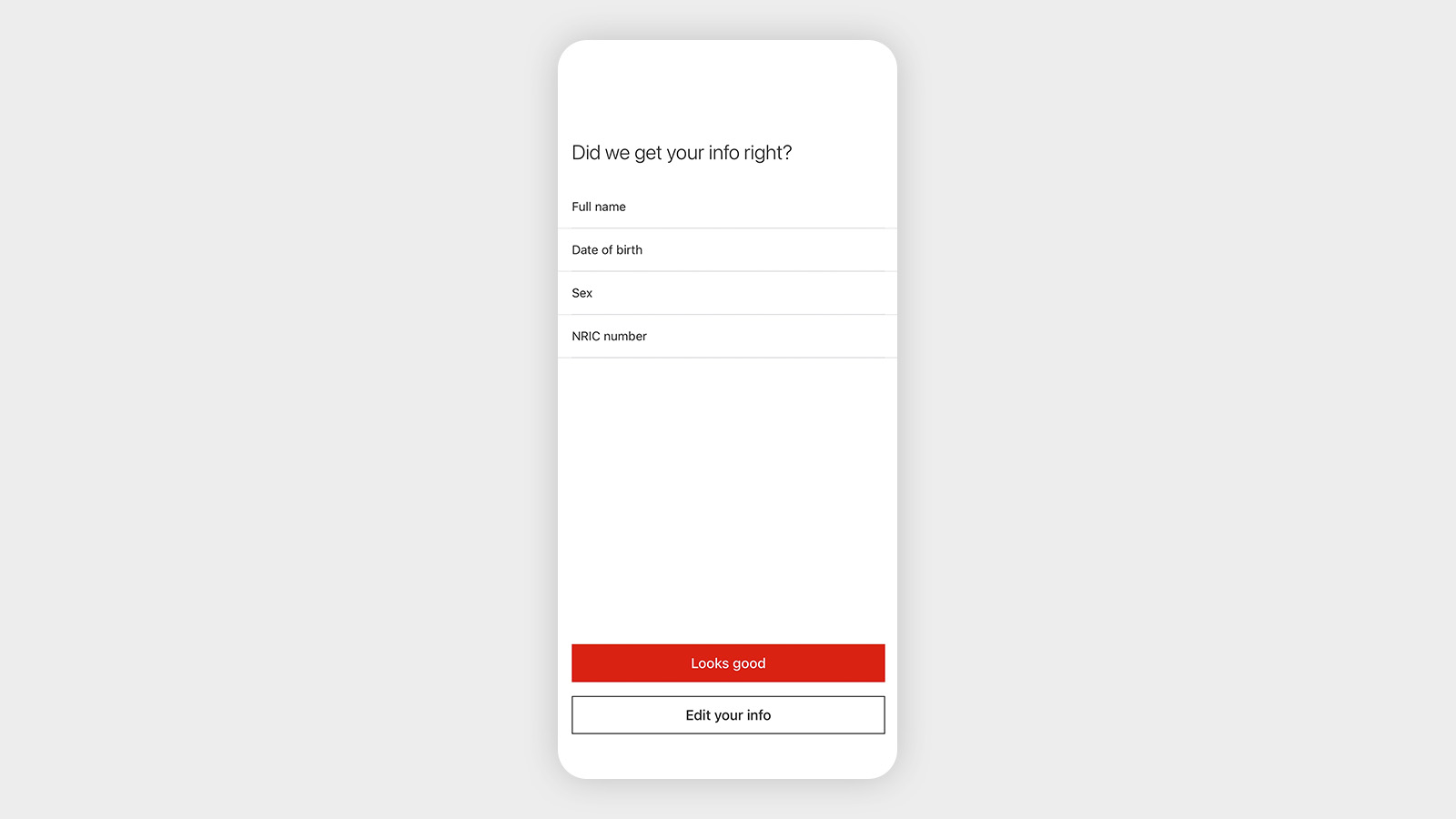

After providing us with your consent to retrieve your personal information from the Myinfo platform, the retrieved information will be used to pre-fill part of the digital application form.

Additionally, your account may be opened instantly when applying using Myinfo with your account number presented at the end of the application journey.

Am I required to upload any documents with Myinfo application?

If you hold a valid NRIC and reside in Singapore, you don't need to upload any documents. If you hold a valid FIN and reside in Singapore, you will need to upload a copy of your passport and proof of your residential address.

Where required, we will ask you to upload additional documents in the application journey. Please follow the instruction on-screen accordingly.

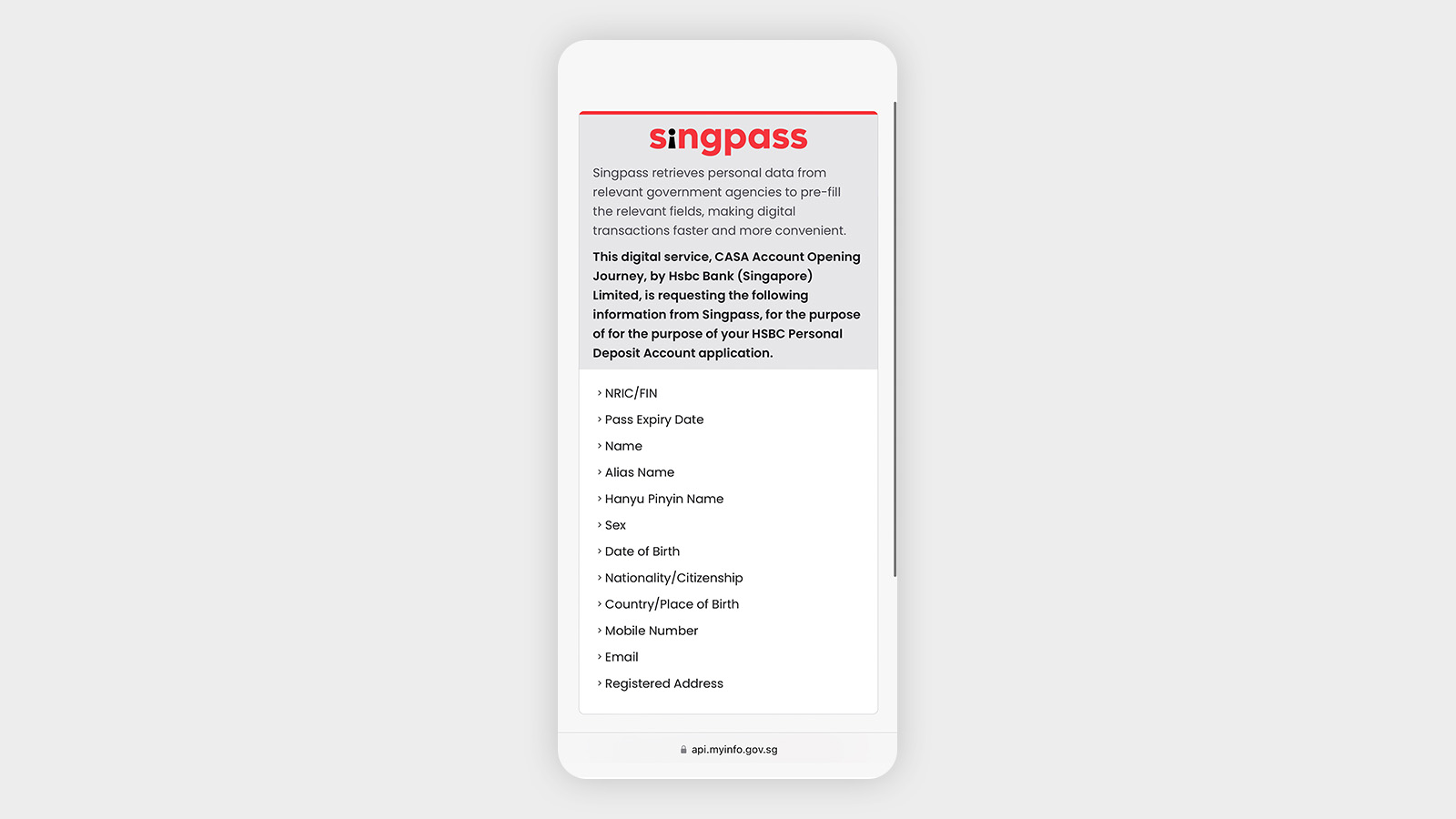

What type of information will be retrieved or accessed by HSBC Singapore from the Myinfo platform?

We will only retrieve and access your personal information for the purpose of your application. The required information will be listed out clearly before you are asked to provide us with your consent to retrieve your personal information from the Myinfo platform.

If I update my personal information in Myinfo after completing my digital HSBC account opening application, will HSBC Singapore get my updated details?

No. If you wish to update your personal information stored with the bank any time after you have submitted your application, please log on to Online Banking, select 'Services' and 'Update Personal Information' to proceed.

You can also complete and submit the Personal Particulars Update Form with the required documents and mail it to us with the Business Reply Envelope provided.

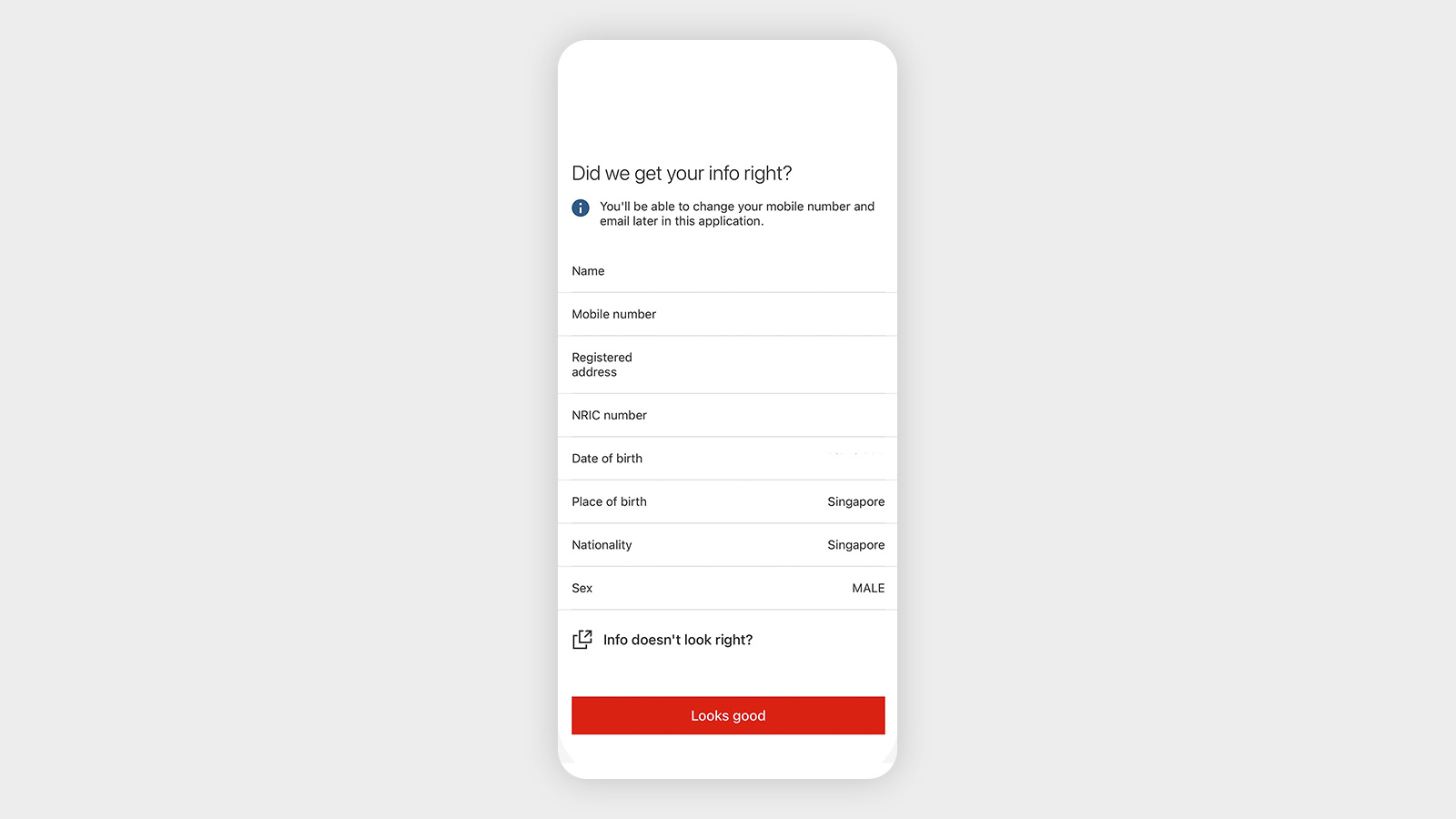

Can I change the pre-filled information in the digital account opening form?

You can update the unverified information from Myinfo in your application.

However, you cannot amend or update the verified information that is pre-populated in your application. If any of your personal information is inaccurate, please update your personal information through the Myinfo

platform before proceeding with your application.

Applying with Myinfo

What's different when applying with Myinfo?

After providing us with your consent to retrieve your personal information from the Myinfo platform, the retrieved information will be used to pre-fill part of the digital application form.

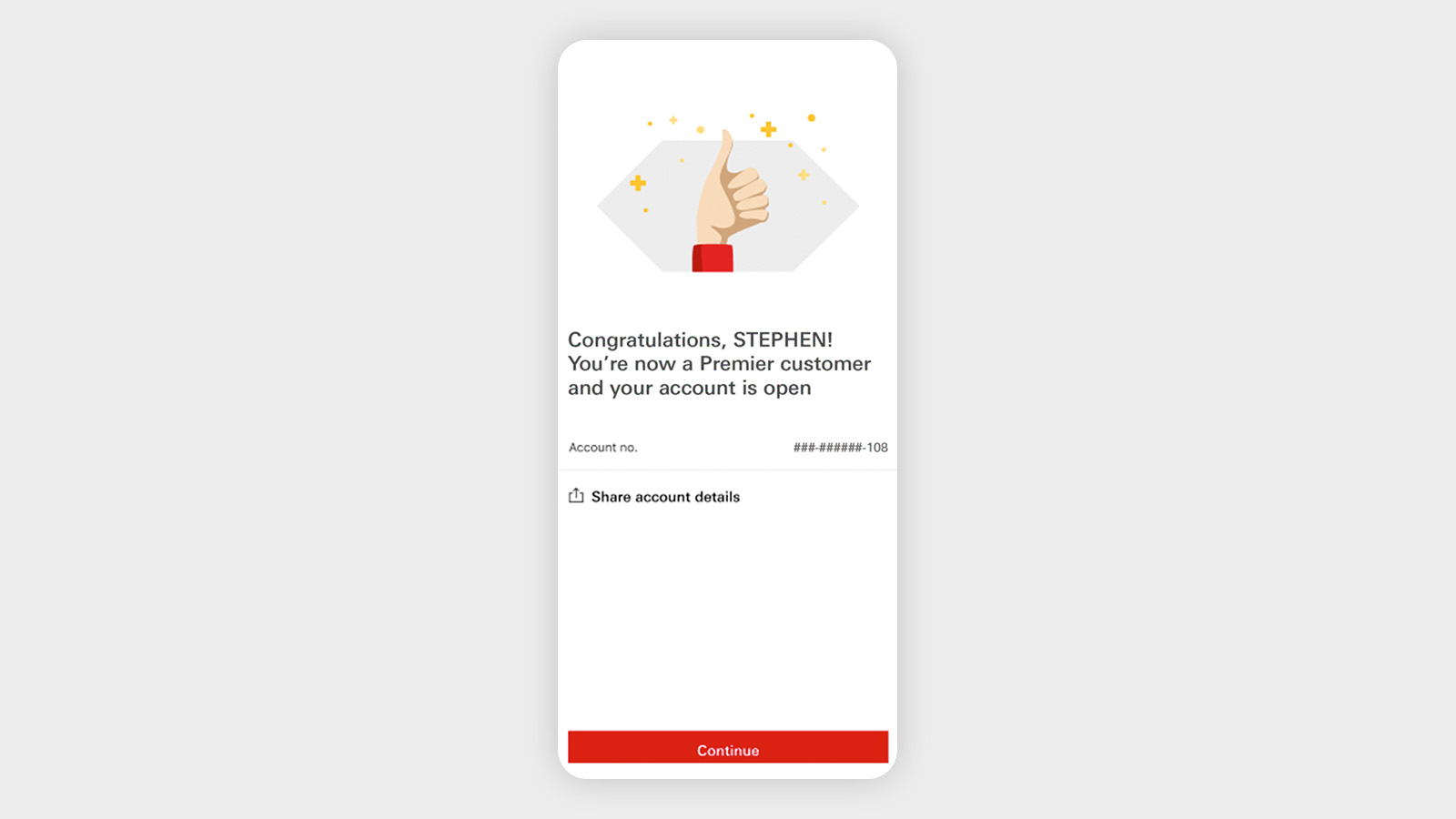

Additionally, your account may be opened instantly when applying using Myinfo with your account number presented at the end of the application journey.

Am I required to upload any documents with Myinfo application?

If you hold a valid NRIC and reside in Singapore, you don't need to upload any documents. If you hold a valid FIN and reside in Singapore, you will need to upload a copy of your passport and proof of your residential address.

Where required, we will ask you to upload additional documents in the application journey. Please follow the instruction on-screen accordingly.

What type of information will be retrieved or accessed by HSBC Singapore from the Myinfo platform?

We will only retrieve and access your personal information for the purpose of your application. The required information will be listed out clearly before you are asked to provide us with your consent to retrieve your personal information from the Myinfo platform.

If I update my personal information in Myinfo after completing my digital HSBC account opening application, will HSBC Singapore get my updated details?

No. If you wish to update your personal information stored with the bank any time after you have submitted your application, please log on to Online Banking, select 'Services' and 'Update Personal Information' to proceed.

You can also complete and submit the Personal Particulars Update Form with the required documents and mail it to us with the Business Reply Envelope provided.

Can I change the pre-filled information in the digital account opening form?

You can update the unverified information from Myinfo in your application.

However, you cannot amend or update the verified information that is pre-populated in your application. If any of your personal information is inaccurate, please update your personal information through the Myinfo platform before proceeding with your application.

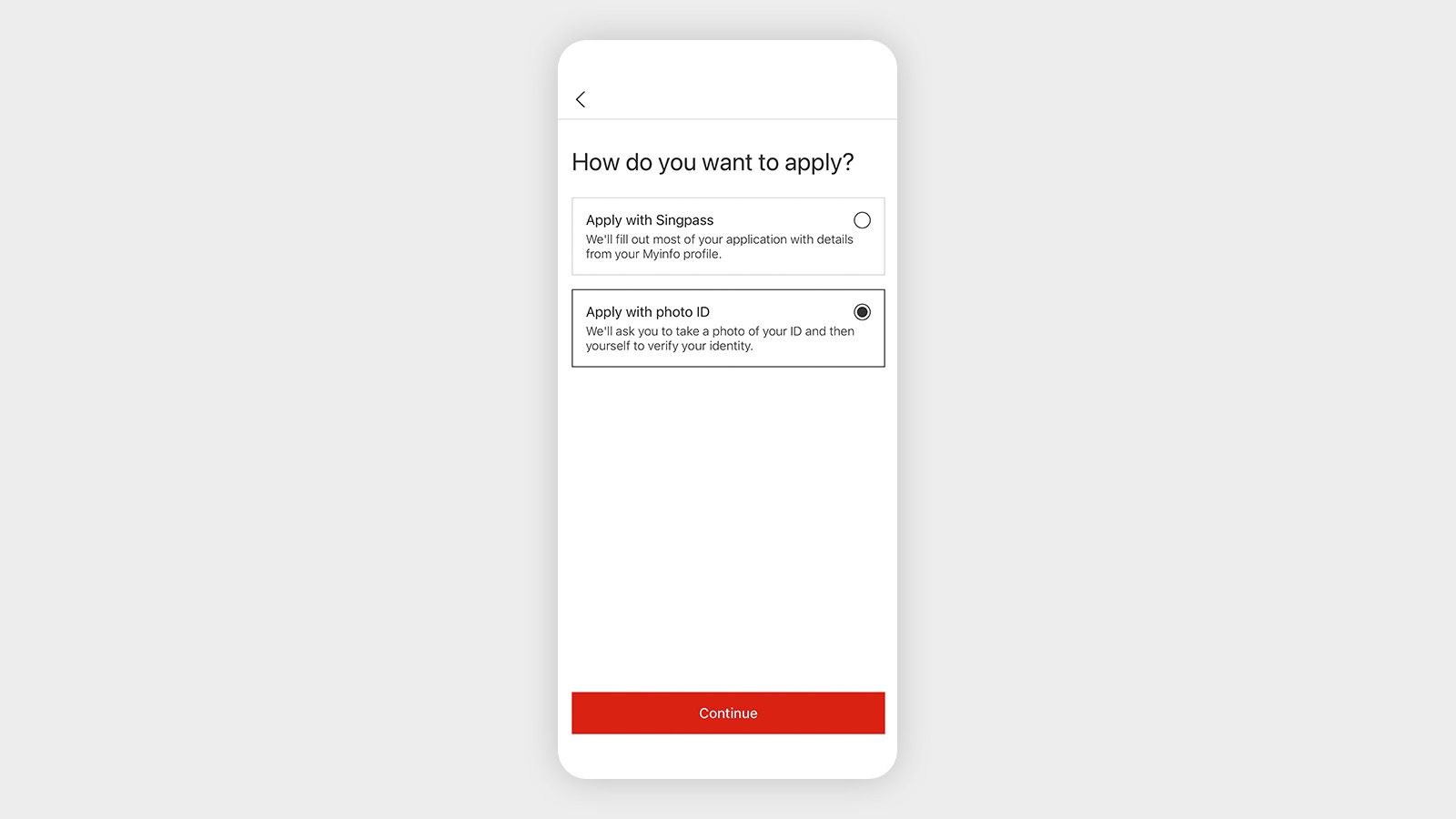

Apply with photo ID

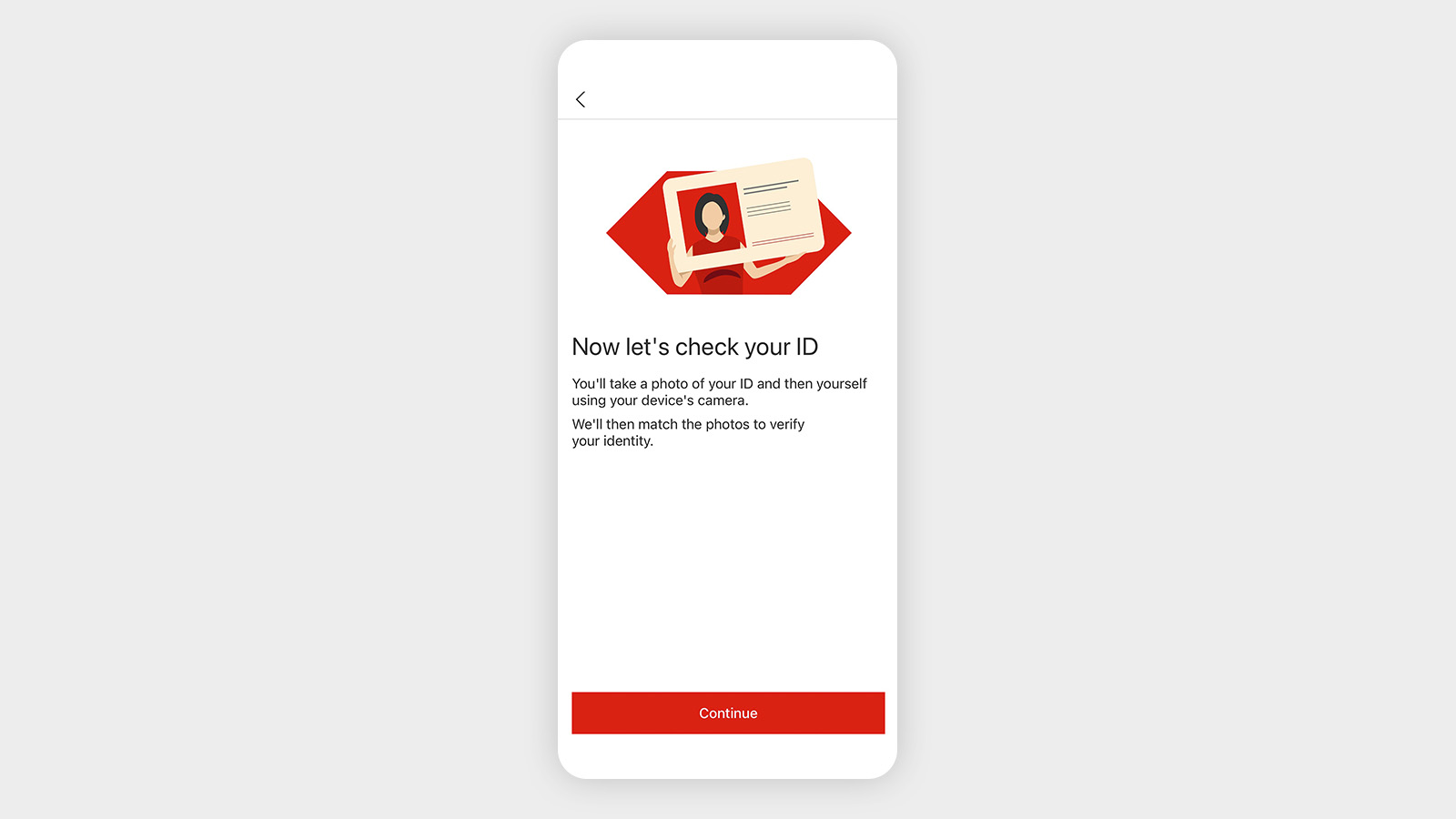

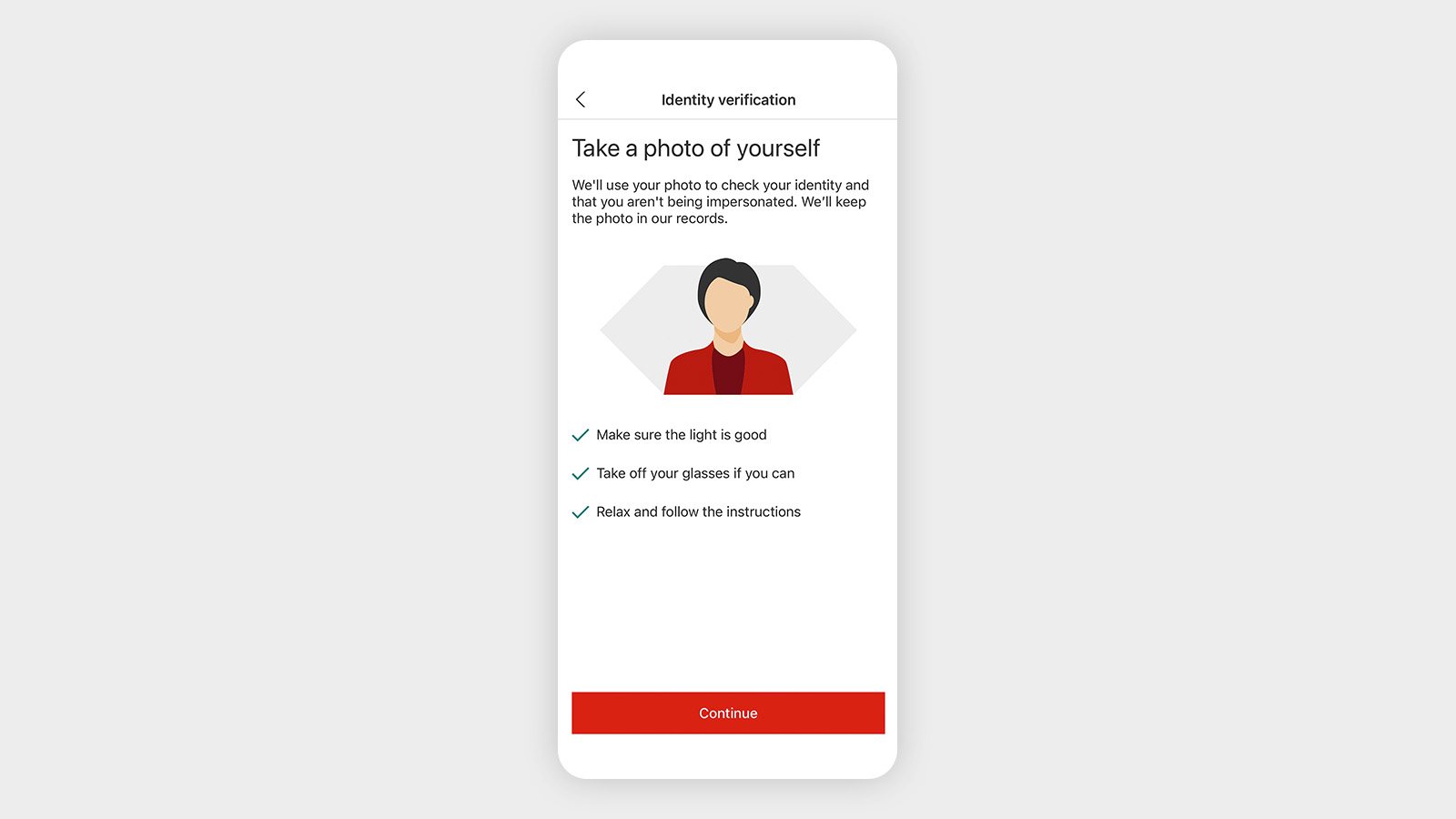

What is photo ID?

HSBC photo ID allows us to verify your identify during the digital account opening journey.

It simply requires two steps: take a photo of your ID document; take a selfie.

What are the benefits of using photo ID?

1) It allows us to verify your identity thereby open an account for you instantly and remotely; and

2) It will help you pre-fill the application using the data on your ID documents, hence reduce the time taken to submit the application.

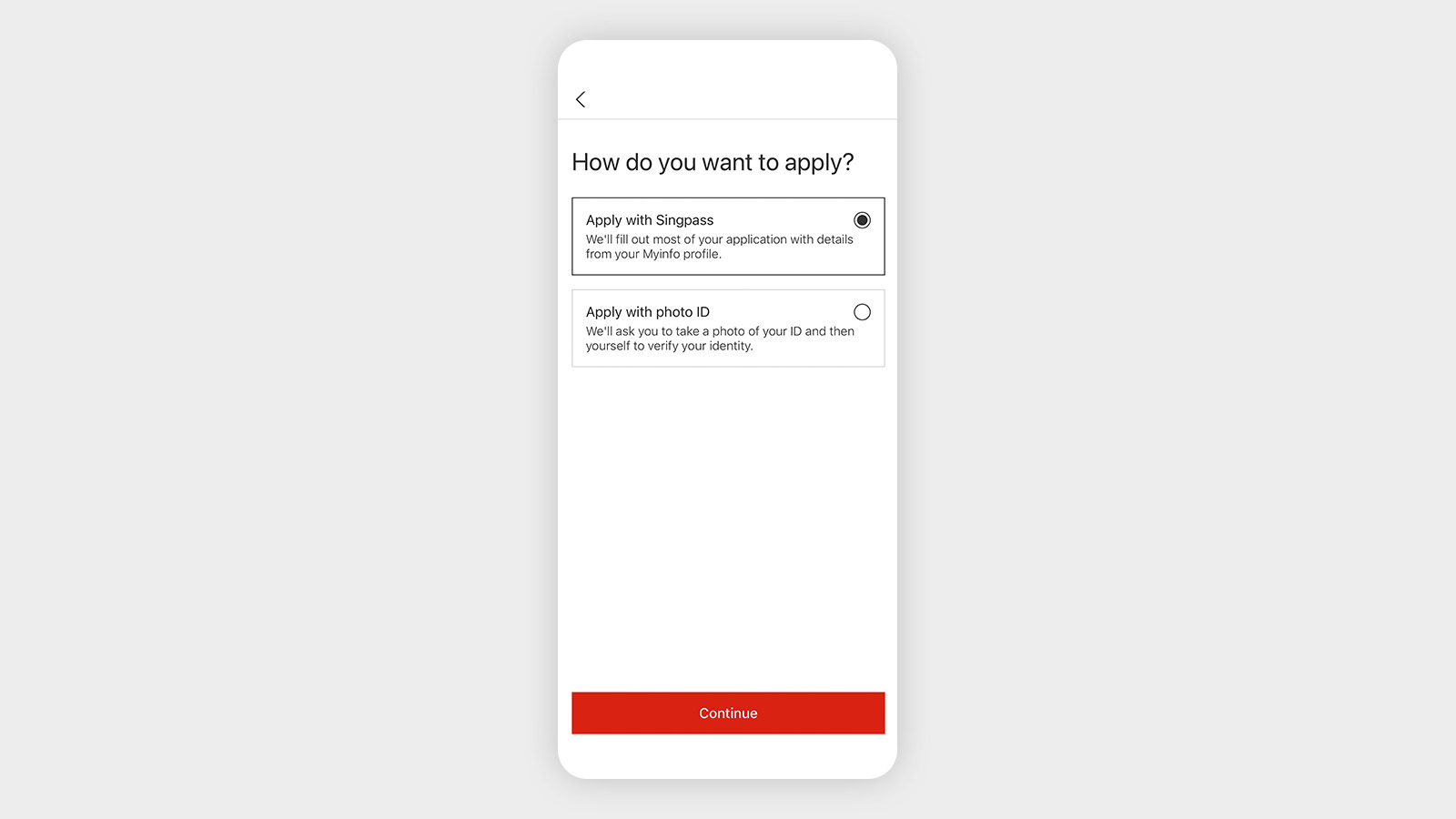

Can I use both Myinfo and photo ID in the journey?

No, you can choose either Myinfo or photo ID to submit your application and not both. If you are a Singpass holder residing in Singapore, you are recommended to use Myinfo. Else, you can complete the journey via photo ID.

How soon will my account be opened after application submission?

If you pass all the photo ID checks, you will get your account number instantly. However, you will need to wait for the notification email to be able to transact through the new account.

If the account number is not created in the journey, please wait for our staff to contact you for supporting documents and/or clarifications.

Account Opening Process

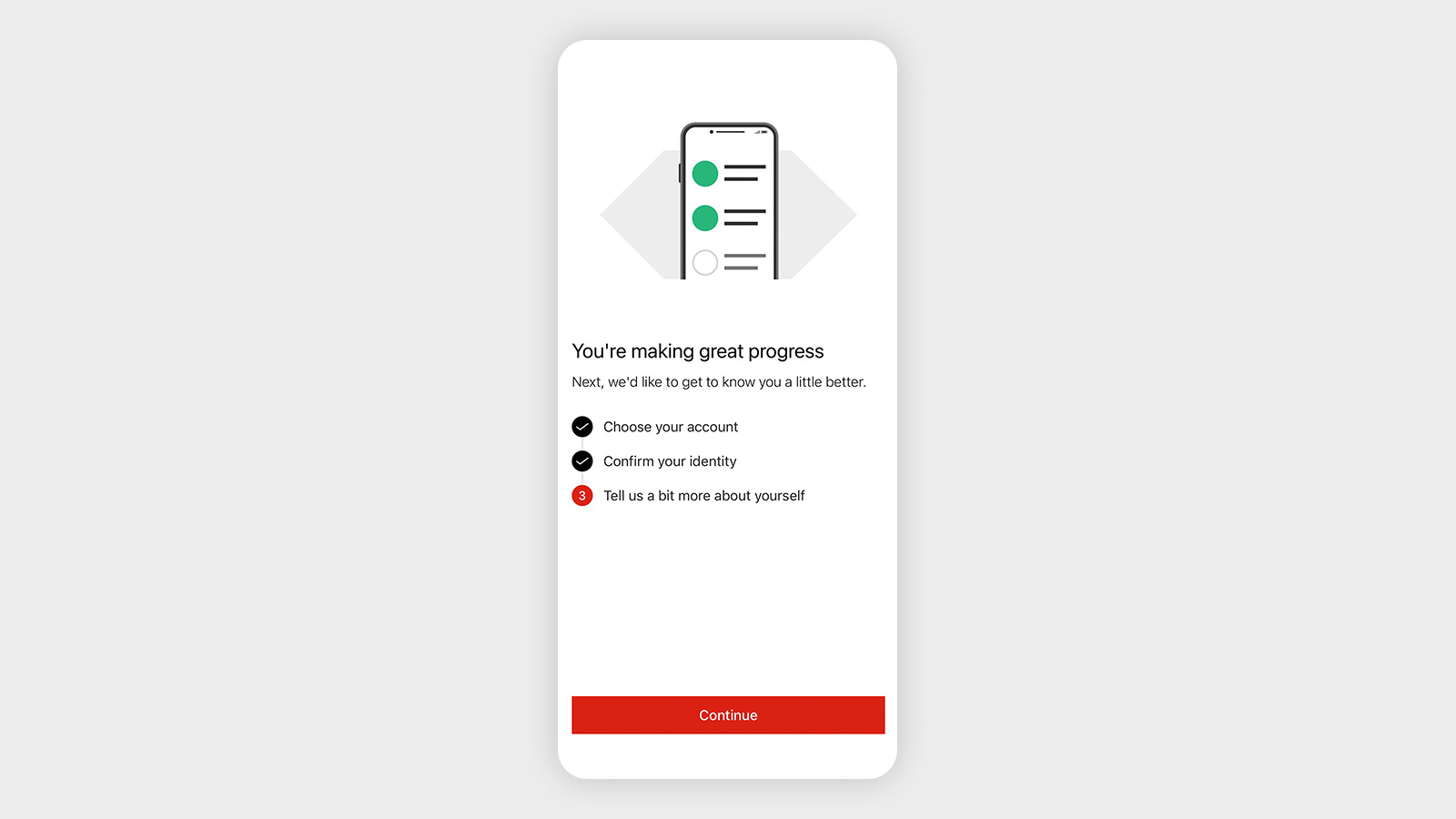

Open your account in few simple steps

What kind of account can I open using the digital account opening journey?

You can open a HSBC Everyday Global Account. If you are residing in Singapore, you can also open Singapore Dollar Savings Account. Please note that you can't use the digital account opening journey to open an investment account or apply for a credit card or cheque book. You can do these at our branches, or using online banking.

How can I register for online banking access?

Upon receiving your debit card and ATM PIN by post, you'll be able to use that to register for online banking. Alternatively, you can also register via Singpass.

I need to open an investment account as well. How do I do that?

You can open an investment account after logging into online banking or HSBC Singapore app. Alternatively, please visit one of our branches to open your investment account. You'll need to bring along a proof of address issued within the past 3 months.

How do I order a chequebook?

Your signature is required before you can order a chequebook. Please visit one of our branches to submit your signature in person.

How will I know if I've successfully opened an account?

You'll see your account number on a confirmation message when you complete the digital account application form. In addition, we'll send a confirmation email to your registered email address once you are able to transact using your new account.

I accidentally closed the window in the middle of the account opening process. What should I do?

If you closed the window before you saw your application status on the confirmation page, you'll need to start a new application.

If you closed the window after seeing the confirmation page, please check if you've received our email confirmation. Otherwise, please contact us on +65 6472 2669 for assistance.

If I'm not using Myinfo or photo ID to apply, how do I perform ID verification?

Once we've received your application, we'll send clear instructions for ID verification by email. There are 2 verification methods:

- By online video conference. We will contact you to make an appointment. You will need your NRIC Card/passport/MyKad with you to verify your identity.

- In branch, with your NRIC Card/Passport/MyKad and proof of your latest residential address.

Can I save my application in progress with filled information?

The bank will not be able to receive your application before you submit it. Once you've closed out of the application before you see the confirmation page, you'll have to start a new application.

Deposit Requirements

Do I need to deposit a certain amount of money into my newly opened account?

Different account types will have different deposit requirements. You can find out about deposit requirement for your chosen account at https://www.hsbc.com.sg/accounts/

Does my newly opened account support multiple currencies?

This depends on which account you've opened. HSBC Everyday Global Accounts support up to 11 different currencies in one account, which you can manage anytime, anywhere. For more information, please visit https://www.hsbc.com.sg/accounts/products/everyday-global/

Other Inquires

How soon can I use my account?

As soon as you open your account and received your PIN, you can register with online banking and can start depositing money.