Turn your credit limit into cash

Use the available credit limit from your credit card and convert it into cash. You can then use it to make a lifelong dream a reality, or to pay off outstanding balances to avoid higher interest.

With our low rates, you can enjoy more financial freedom. Check out our latest promotional interest rates on the HSBC Singapore app.

Save more when you apply Balance Transfer via HSBC Singapore app

You can get up to SGD100 cashback.

1) SGD20 cashback for first-time balance transfer customer, and

2) SGD80 cashback when your balance transfer amount is more than SGD20,000 and processing fee waiver, and

3) provide marketing consent for all channels by filling in this form.

Register for the HSBC Balance Transfer Cashback campaign by sending an SMS to 74722 in the format: BTCB<space>Last 4 digits of HSBC credit card.

Promotion is valid from 13 August - 31 October 2025. T&Cs apply.

What you'll get with a Card Balance Transfer

Things to know

| Who can apply |

To apply for a Balance Transfer, you must be the primary cardholder of an HSBC credit card.

Balance Transfer is not applicable to USD cards and corporate cards.

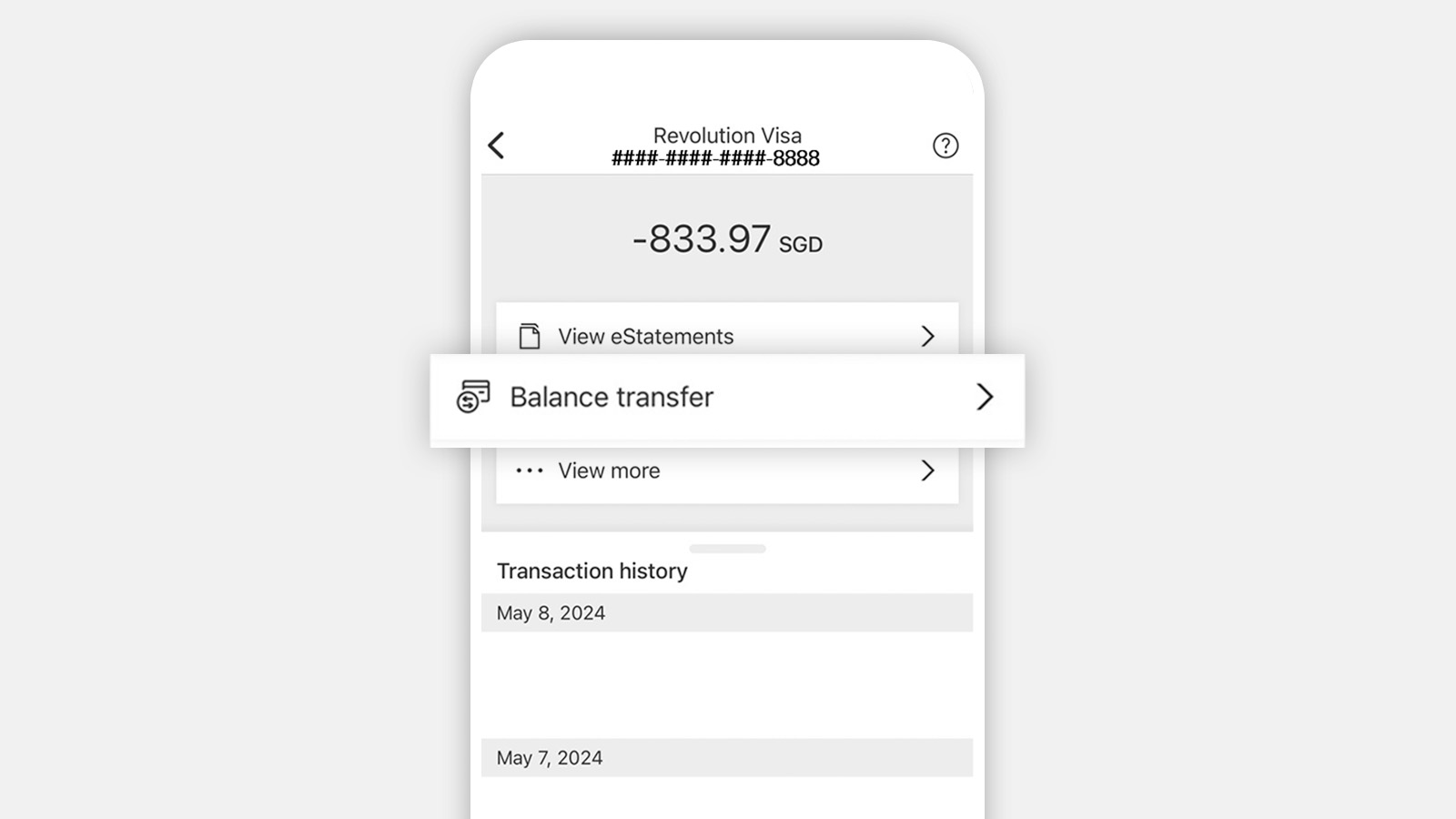

How to apply via HSBC Singapore App

- Log on to HSBC SG app and select your credit card account

- Tap on 'Balance Transfer'

Ready to apply?

Log on to the app and select 'Balance Transfer' to get started.

Don't have the app yet? Download it now.

Scan the QR code to download the app.