On this page:

Balance To Income

The introduction of Balance To Income (BTI) across Financial Institutions (FI) in Singapore is intended to help borrowers avoid accumulating further debt.

Example: A customer with Annual Income of S$36,000 with HSBC and total IBB of S$6,000 across FI will have a BTI ratio of 2x. This is derived based on 6,000 ÷ (36,000 ÷ 12).

Note: the computation of your BTI ratio may differ across different FI, depending on the income record you had provided to the respective bank. This may result in different BTI status at different FI.

When your BTI ratio exceeds the prevailing cap for 3 consecutive months, you will not be able to:

- charge new amounts to your existing credit cards and/or unsecured facilities with HSBC ;

- request for credit limit increases on existing credit cards and/or unsecured facilities with HSBC ;

- apply for new credit cards and/or unsecured facilities with HSBC.

The BTI cap is phased in as follows:

- 24 times with effect from 1 June 2015

- 18 times with effect from 1 June 2017

- 12 times with effect from 1 June 2019

The following groups of customers are exempted from BTI suspension:

- Foreigners

- Individuals whose Annual Income exceeds S$120,000. Please provide your income documents for HSBC to update accordingly.

- Individuals whose Net Personal Assets exceeds S$2million. Please provide the necessary documents for HSBC to review. Review of Net Personal Assets form

To avoid interrupted usage of your HSBC credit cards and/or Personal Line of Credit account(s), you should:

- provide your latest income document to HSBC, Income Update form

- maintain your IBB across FI to be lower than the prevailing BTI cap

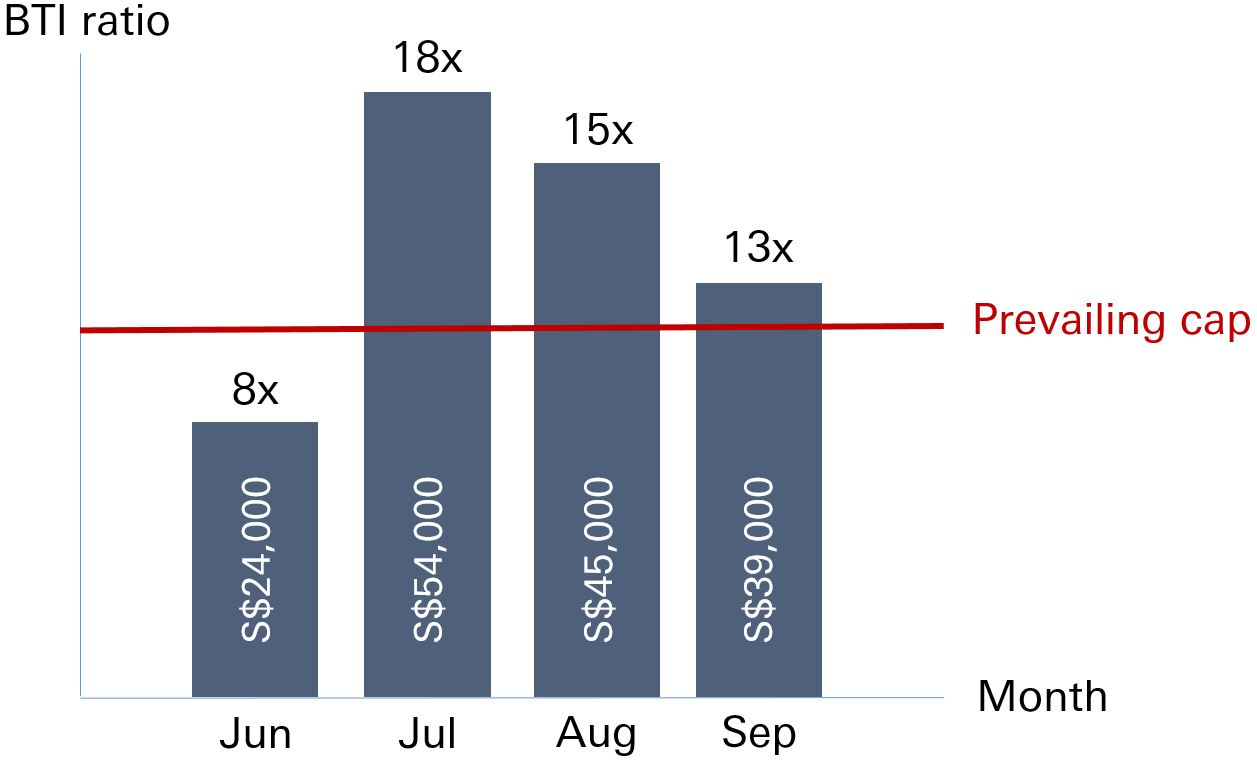

Here's an illustration on how BTI may impact a customer.

Customer's income record with HSBC is S$36,000, and has the following facilities with HSBC: two credit cards, a personal loan and a secured home loan. Customer also has other unsecured facilities with two other banks in Singapore.

| Month | IBB with HSBC | IBB with other FI | Total IBB | BTI ratio | Remarks |

|---|---|---|---|---|---|

| Jun | S$24,000 |

NIL |

S$24,000 |

8x | BTI ratio is below the prevailing cap and thus no impact. |

| Jul | S$20,000 |

S$34,000 |

S$54,000 |

18x | BTI ratio for the month increased to 18x, and is above the prevailing cap. A notification would be sent to customer. |

| Aug | S$15,000 | S$30,000 |

S$45,000 |

15x | While the total IBB reduced, the BTI ratio continued to exceed the prevailing cap for 2 consecutive months. A second notification would be sent to customer. |

| Sep | NIL | S$39,000 |

S$39,000 |

13x |

Even though there isn't any IBB with HSBC, the BTI ratio would still be calculated. And since the BTI ratio exceeded the cap for 3 consecutive months, a notification would be sent to customer to inform that the unsecured facilities with HSBC has been suspended. |

| Month | Jun |

|---|---|

| IBB with HSBC |

S$24,000 |

| IBB with other FI |

NIL |

| Total IBB |

S$24,000 |

| BTI ratio | 8x |

| Remarks |

BTI ratio is below the prevailing cap and thus no impact. |

| Month | Jul |

| IBB with HSBC |

S$20,000 |

| IBB with other FI |

S$34,000 |

| Total IBB |

S$54,000 |

| BTI ratio | 18x |

| Remarks |

BTI ratio for the month increased to 18x, and is above the prevailing cap. A notification would be sent to customer. |

| Month | Aug |

| IBB with HSBC | S$15,000 |

| IBB with other FI |

S$30,000 |

| Total IBB |

S$45,000 |

| BTI ratio | 15x |

| Remarks |

While the total IBB reduced, the BTI ratio continued to exceed the prevailing cap for 2 consecutive months. A second notification would be sent to customer. |

| Month | Sep |

| IBB with HSBC | NIL |

| IBB with other FI |

S$39,000 |

| Total IBB |

S$39,000 |

| BTI ratio |

13x |

| Remarks |

Even though there isn't any IBB with HSBC, the BTI ratio would still be calculated. And since the BTI ratio exceeded the cap for 3 consecutive months, a notification would be sent to customer to inform that the unsecured facilities with HSBC has been suspended. |

When customer exceeds the prevailing cap for 3 consecutive months:

- The credit card and personal loan with HSBC would be suspended. But the secured home loan with HSBC would not be impacted.

- The unsecured facilities with other FIs may be suspended (if the Annual Income record is the same or lower with the other banks).

- Customer will not be able to request for credit limit increase on existing unsecured facilities.

- Customer will not be able to apply for new unsecured facilities.

Delinquency

If any of your unsecured facilities with HSBC is delinquent, it would result in all your unsecured facilities within HSBC to be suspended.

You will not be able to:

- charge new amounts to your existing credit cards and/or unsecured facilities with HSBC ;

- request for credit limit increases on existing credit cards and/or unsecured facilities with HSBC ;

- apply for new credit cards and/or unsecured facilities with HSBC.

Delinquency threshold is at 60 days past due, but may also occur earlier depending on individual FI .

Notification and Uplift of Suspension

Prior to suspending your account(s), a letter and/or SMS would be sent to notify you on your account status. Please ensure that you take the necessary steps to avoid suspension of your account(s).

If your account(s) has been suspended and would like to uplift the suspension you will need to:

- Ensure all your unsecured credit facilities granted by HSBC is no longer delinquent, and

- Ensure your total IBB across all FI is below the prevailing BTI cap, and

- Provide a copy of your latest income document(s), and

- Complete request form for uplift of suspension, Review of MAS Suspension form

Note: Review would be subject to HSBC's approval.