Rise above investment uncertainty to achieve stable returns

So you've tapped into an investment strategy that's delivering better returns than the others. Wouldn't it make sense to put all your money where it will perform best? Besides, it's easier and cheaper to keep an eye on a single investment. Maybe not.

There's no such thing as a winning ticket

Riding on a single investment can be risky. Investments can fluctuate severely without warning, and even the smartest investors can't always predict how the market will move. Putting all your money in one investment puts you at risk of large losses if the market takes a downturn.

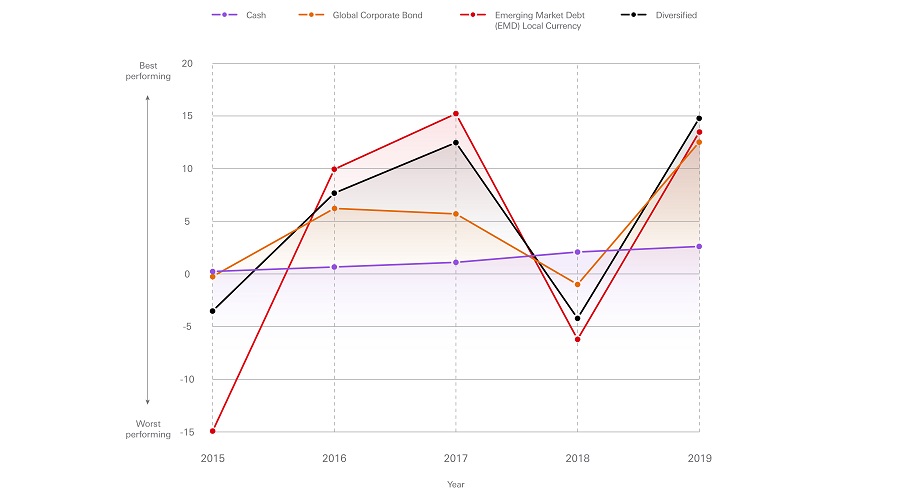

Take a look at how returns have fluctuated across different investment markets between 2015 and 2019. As emerging market debt (EMD) shows, the asset class that performs the best one year can perform the worst another year.

Markets fluctuate, and so do asset classes

Source: Morningstar, HSBC Global Asset Management, data as at 31 December 2019. All returns in USD, total return. Indices used: MSCI World Index; MSCI Emerging Market Index; J.P. Morgan GBI-EM global diversified series (EMD local currency); Bloomberg Barclays Global Aggregate Corporate Bond Index; ICE Bank of America Merrill Lynch Emerging Market Bond Index (EMD hard currency); ICE Bank of America Merrill Lynch Global High Yield, Citigroup World Government Bond Index, FTSE EPRA/Nareit Global Real Estate Index, 3-month ICE LIBOR. Bond indices are hedged, ex EMD local currency (i.e. global government, global corporate, global high yield, EMD hard currency). Equities are unhedged. The 'Diversified' performance was calculated from the average performance across all of the stated indices.

Why diversification is your best defence against uncertainty

Investment portfolio diversification is comparable to how supermarkets import meat from different countries/regions. If an animal virus wipes out the stock from one exporter, supermarkets can still rely on stock from other countries/regions for untainted meat. Likewise, the best way to lower your financial risk is to spread your money across a range of different asset classes that will react differently to events affecting the economic landscape.

This is even more important in today's market, which is being buffeted by geopolitical uncertainties and macro-environmental factors. Even if a sudden event causes one type of investment to decline, other asset classes may absorb some of the impact on your portfolio, reducing the risk of loss and offering better stability.

What does a well-diversified portfolio look like?

Our bodies need a balance of different types of nutrients from all the different food groups to stay healthy. Likewise, you need a portfolio of investments that performs differently, spread across a diverse range of asset classes, currencies and geographies. Not only does this reduce risk, but this investment strategy also opens up more opportunities for returns.

Adding market-driven returns with core-satellite approach

Even if you have a stable and diversified investment portfolio, there's nothing stopping you from pursuing more market-driven opportunities such as real estate, technology or commodities to suit your risk appetite.

This is called the core-satellite approach. It's a two-pronged investment strategy that combines a well-diversified 'core' portfolio with market-driven 'satellite' investments that are shorter term. This protects your investments during market downturns, while giving you room to pursue special investment situations and take advantage of market trends.

What do you want from your investments? To learn about more portfolio diversification strategies, or to discover which portfolio works best for you and how it may perform under different market conditions, ask HSBC about Wealth Portfolio Intelligence Service today.

Ready to get started?

If you already have an investment account, log on to trade now.

Don't have an account yet? We can help you get started. Just get in touch with us here.